Dear Reader,

What happened behind closed doors in Bali?

There was very little said about it, yet it was one of the most important gatherings of the year. And what followed was quite conspicuous…

On July 14, the day before the G20 finance ministers and central bank governors – representing more than 80% of the world’s GDP – gathered, the U.S. dollar reached a high that it has not seen since 2002:

And that’s a problem… A problem that was most certainly the hottest topic of discussion in Bali. Which is why the seemingly perfectly timed decline of the U.S. dollar over the four weeks that followed seemed so obvious. It fell more than 3%, which in currency terms is a major move in such a short period of time.

Yet there’s a larger problem: The weaker dollar didn’t stick. As we can see above, the dollar has sharply rebounded in the last seven days.

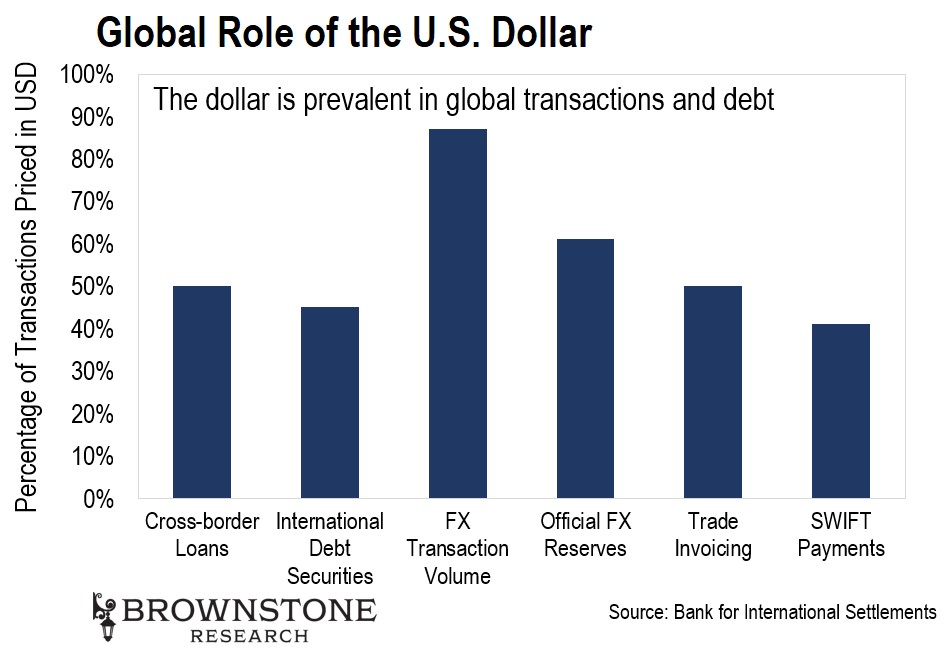

The issue at hand is rooted in the prevalence of the U.S. dollar in global transactions and debt. About 85% of all foreign exchange transactions are conducted with U.S. dollars. More significantly, about half of all cross-border loans and international debt are all priced in U.S. dollars. And not surprisingly, 61% of all foreign exchange reserves are held in dollars:

The above chart shows precisely why this strong of a dollar is such a problem on a global scale. While Americans are certainly enjoying their currency on trips to Europe and Asia this year as the dollar buys more, this is actually cause for deep concern. If this strengthening continues, it could collapse the global financial system.

The world has been changing at such a torrid pace over the last decade, it’s hard to think back to what things were like the last time the dollar was this strong. The year 2000 is so far back in the rearview mirror it feels like ancient times. Back then, global debt was just under $100 trillion. That may sound like a lot, but on a global level, it was manageable.

Today, it’s a different story. Global debt has skyrocketed to more than $305 trillion as of the first quarter of this year. That’s more than three times the amount we had 20 years ago.

And that’s the problem… That’s why it’s different this time.

That’s why the G20 finance ministers and central bank governors must find a way to weaken the U.S. dollar. But they can’t do it without the support of the U.S. Federal Reserve.

The U.S. dollar has strengthened by more than 21% since January of 2021. That’s a remarkable swing for any major currency, let alone the world’s reserve currency. It makes it very difficult for countries to absorb the effect of the currency exchange rates with regard to U.S. dollar-denominated debt.

Developing countries are always the ones to fall first. Sri Lanka has already defaulted on its debt. Russia has done the same, but for different reasons. But the likelihood of default across a string of countries like El Salvador, Ghana, Tunisia, Pakistan, Egypt, Kenya, and Argentina seems to grow by the day.

If a string of defaults is allowed to happen, it will become a cascade and potentially a house of cards – the whole system collapses.

And while there are nefarious organizations out there like the World Economic Forum, which would relish such a dramatic collapse – read, opportunity – for a “global reset,” regardless of the death and destruction it would cause. Most of us simply don’t want that to happen.

Which is why the Federal Reserve will need to act to weaken the dollar… quickly. Developing markets can’t absorb the rapid rise in the U.S. dollar and the inflation that we are experiencing at the same time. These countries simply can’t manage or afford to refinance all of their debt.

And while the Federal Reserve has stopped its easing and increased interest rates, the effect is clear. There is less risk-taking, rising defaults, and a major contraction in cross-border capital flows.

That’s why this week is so important. Fed Chair Powell speaks at 10 AM ET this Friday at the annual Jackson Hole Economic Symposium, hosted by the Federal Reserve Bank of Kansas City.

It pains me to place such importance on an organization that has been so inept in managing monetary policy over the years. But “they” have done such a good job at bad monetary policy that the economy, and thus the markets, seem to be run on a light switch.

Print money, expand Fed balance sheet, lower interest rates = economy on, risk on, healthy markets. Reduce balance sheet, raise interest rates = economy off, risk off, markets crash.

Friday’s presentation isn’t just about the U.S. Yes, we’re less than three months out from mid-term elections, but that won’t matter much if a wave of global defaults kick in on top of the inflation and weakening economy that we are experiencing right now.

The bigger issue is how and when to weaken the U.S. dollar. And I suspect the most likely outcome will be to print, print, print… and purchase sovereign debt primarily in Japan and the E.U. in an effort to weaken the dollar against the other major world currencies.

The Fed has backed itself into a corner of its own doing. And it only has two choices to make now – It can continue down its path of ever-increasing interest rate hikes, which will bring about devastation at home and abroad, or it can pivot, start to ease, and turn things back “on” again.

Hopefully, we’ll get a sign of what’s to come for the rest of the year on Friday. I know which option I’d vote for.

Publishing giant Pearson just announced a major shift in its business strategy. The company is going to start selling its textbooks as non-fungible tokens (NFTs).

I know this sounds strange on the surface. But it makes perfect sense.

Let’s use college textbooks to illustrate why…

If I think back to my university experience, there was a huge market for used textbooks. I’m sure it was the same for most readers.

It started at the university bookstore. This is where we would buy a brand-new copy of our textbooks for the upcoming semester. And they certainly weren’t cheap – not for college students, anyway.

The good news is that we could always sell our textbooks back to the bookstore at the end of the semester or to another student.

Typically, we would recoup less than half of our initial purchase price by doing this… but that’s better than nothing. After all, very few students had any desire to hold on to their own textbooks and they needed the cash from the resale.

But the problem was that in secondary sales, the textbook publisher didn’t make any money. In fact, the publisher didn’t even know that the transaction took place.

That’s been a fundamental problem in the publishing industry for a long time. Companies like Pearson only got paid from that first sale when we bought a new textbook.

This is why textbook publishers have always scrambled to put out new volumes frequently. In most cases, the information hasn’t really changed that much. The real motivation was that they need a new version to generate more sales.

That’s why NFTs make perfect sense.

For starters, many textbooks are now issued in digital format today. It’s not like the old days when we had to lug around big heavy backpacks.

And by producing these digital textbooks as NFTs, the publishers can program a smart contract to kick back a percentage of every future sale. That way companies like Pearson can get paid a commission on every sale.

This would be absolutely transformational for textbook publishers. Revenues will go up… And they won’t have to constantly put out new volumes just to get new sales.

So I think we’ll see all textbook publishers migrate to this format very quickly. In fact, most forms of digital publishing will likely go in this direction.

The bottom line is this – the NFT market may have cooled down recently, but this asset class isn’t going anywhere. NFTs will become a key source of recurring revenue for any creator or company that produces digital products that are likely to have secondary sales.

The international race for autonomous driving supremacy is heating up.

Chinese tech giant Baidu just received permits to offer fully driverless robotaxi services in two cities – Chongqing and Wuhan. This is a major milestone.

We can think of Baidu as the Google of China. And there’s no doubt that Baidu measures itself against Google’s self-driving division Waymo. As we have discussed before, Waymo is already offering driverless robotaxi services in Phoenix and San Francisco.

So Baidu is racing to keep a similar pace to Google.

As for its self-driving cars, they do not have a steering wheel or even a front seat. Here’s a look:

Baidu’s Self-Driving Car

Source: Baidu

Baidu’s robotaxis are optimized for autonomous driving. They provide plenty of space and comfort for passengers.

But there’s a catch…

Baidu can only operate in specific zones within the two cities. That means they are limited to a geofenced area. They aren’t able to travel freely throughout the cities.

This tells us that Baidu’s self-driving software is not fully developed yet. It can only operate within an area in which all the roads and drop-off points have been precisely mapped.

This has been the problem that Tesla has been solving for with its full self-driving software. It has developed a neural network, and AI, that is intelligent enough to drive on roads that it has never traveled on before.

Tesla isn’t 100% there yet, but it is getting very close and will likely deliver a level five autonomous driving package by the end of this year.

Still, Baidu’s progress is an important stepping stone. Baidu will gather data from every ride and use that to improve its software over time, just as other players in the industry have done. And removing the safety driver from the front seat is a major step.

Looking forward, the next goal for Baidu is to get permits to operate in Beijing, Shanghai, and Shenzhen. These are three of China’s largest cities.

So the race for self-driving supremacy is on. I’m excited to see how Google responds to stay one step ahead of its China-based lookalike.

As regular readers know, we stay on top of tangible and material developments in the worlds of tech, biotech, business, and economics. Tracking important developments makes us smarter and gives us a view of the future both near and far.

Yet as the rate of technological advancement continues to accelerate, society is going to have to start wrestling with some more complex philosophical and ethical issues.

We’ve been scratching the surface of these complex issues with regard to genetic editing technologies and its implications for the future of the human race. And we’ll discuss another sticky subject tomorrow in The Bleeding Edge.

Another ripe area for discussion is around artificial intelligence (AI). A couple of months ago, we had a look at claims made by a Google engineer that one of its AIs was sentient. Google denied that – and ultimately fired the engineer for sharing his thoughts on the matter.

When an AI becomes sentient is a very complex matter. So complex in fact, it is going to be hard for us to clearly determine when it happens. And while I don’t believe that time has come yet, I do believe that we’ll see it happen within the next six years.

Which raises an important question. Sentient or not, if an AI creates something (its own intellectual property per se), does that confer rights of ownership to the AI?

I bring this up today because I was going through a recent U.S. federal court ruling on the matter. It was an interesting case where a programmer was trying to have patents issued in the name of an AI that created software.

In fact, the programmer was pushing this in the U.S., the European Union (E.U.), the United Kingdom (U.K.), and Australia. But he lost his case in each jurisdiction.

Per the U.S. federal court’s ruling, the Patent Act states that an inventor must be an individual. And the judge ruled that “individual” means human. As such, the judge said an AI is not entitled to intellectual property (IP) rights.

That said, we can be sure that the issue is far from over.

We are just in the early days of tackling very complex questions around the rights of an AI. In the years to come, AIs will become a much greater part of our society.

The more that happens, and the more they create, the more often this issue becomes an issue – especially when humans believe that an AI has become sentient.

Years ago, I made a prediction that an artificial general intelligence (AGI) will have been invented by 2028. And with that, a self-aware AI.

What’s more, at that point, AIs will be able to defend themselves in a court of law. They will be able to “read,” comprehend, and synthesize an entire body of law; something that would not be possible by any human or team of humans. Theoretically, an AI could even become a lawyer.

Imagine that, an AI capable of defending itself in court, with every court case and relevant case law on the planet at its “fingertips.”

This is the world that we are entering into this decade. A literal Pandora’s box.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.