Dear Reader,

Perhaps we’re not in a recession after all…

Venture capital firm Andreessen Horowitz (a16Z) recently wrote its largest check ever – $350 million – to invest in a new real estate company called Flow.

Real estate isn’t exactly a focus for a firm like a16Z, which built its business on high tech, biotech, and – most recently – cryptocurrency investments. But it’s not just the sector that came as a surprise, it’s also the CEO of the new venture: Adam Neumann.

Now, some of us might remember that name. I’ve written about Neumann’s foibles and follies at WeWork in the past in The Bleeding Edge. Over the years, Neumann somehow convinced investors to give him more than $16 billion to build WeWork.

Neumann described WeWork’s mission as:

“Our mission is to elevate the world’s consciousness.”

Fluffy statements like that, devoid of any meaning or substance, always raise the hair on the back of my neck. As an investor, they are a warning sign, flashing “snake oil.” And as a reminder, making the mission even more absurd, WeWork is a real estate company. It leases out office space to individuals and small companies… Nothing more, nothing less.

Yet somehow, someway, Neumann managed to sucker Softbank into investing at a $47 billion valuation back in 2019.

Softbank had drooled at the possibility of an initial public offering (IPO) within a year. But it was a house of cards. Once WeWork filed its S-1 with the U.S. Securities Exchange Commission for its IPO in 2020, Neuman was ousted from the company in about a month.

The business was a disaster. It had lost billions, and there was no clear path toward profitability. And the things that were revealed in the S-1 filing were almost hard to believe:

Neumann had financial interest in four buildings that WeWork leased from him.

Neumann took personal loans out from the company at rates that were below the market to fund his lifestyle. They weren’t small either… One was for $362 million.

And a favorite of mine, Neumann bought the trademark for “We” and then conveniently licensed it back to WeWork for a cool $5.9 million. Really!?! The word “We”?

He even took his investors’ money and made investments into projects that had nothing to do with WeWork.

The list is too long. It was a disaster.

A movie has been made about it. Books have been written. This is exactly the kind of executive that investors want to avoid.

And yet, a16Z wrote a $350 million check for Flow.

Flow, not surprisingly, is a real estate company. Its goal is to disrupt the rental market by purchasing apartments in hot real estate markets like Miami, Fort Lauderdale, Atlanta, and Nashville and then renting them out to people who want to be cool.

Lead investor and a16Z founder Marc Andreessen believes that Neumann will be able to “return to the theme of connecting people through transforming their physical spaces and building communities where people spend most of their time: their homes.”

There’s that fluff again… But it gets better.

Flow is planning on employing a digital wallet that can hold cryptocurrencies, the same wallet that its real estate management software will function with. But, we’re told, the wallet won’t be used to make rental payments using cryptocurrencies. Other than that, no other details were provided.

Again, as a reminder, Flow is a real estate company that will rent apartments. And I’m sure it will have a cool “app” for its renters… But what a digital wallet that can hold cryptocurrencies has to do with that business, I have no idea – another red flag if you ask me.

Making matters even more hysterical, a16Z, just a few months ago, invested in another Neumann deal – Flowcarbon. It’s an unrelated project that wants to create a cryptocurrency backed by carbon credits. Its token is called Goodness Nature Token (GNT). As of last month, the project has already been “paused indefinitely.” Goodness grief.

But that clearly didn’t stop a16Z from moving forward.

Maybe I just don’t “get it.” Perhaps my consciousness hasn’t been elevated yet. Or maybe we really are in a recession, and this is just a ridiculously stupid investment into an executive whose new business is going to burn through investors’ capital as quickly as the last time.

But for the employees, I’m sure there will be some great parties and team-building events along the way… Little to no work required.

As a reminder, CRISPR is like software programming for DNA. It allows us to “edit” genes just like we use “cut” and “paste” features in Microsoft Word. That’s a simplification of course, but CRISPR is a tool that we can use for editing DNA.

And we have several bleeding edge biotechnology companies that have already taken incredibly promising CRISPR therapies into FDA-approved clinical trials. Those are therapies designed to treat a broad patient population. And they have already proven to be both safe and effective. It is still early days, but what we have already seen is incredible.

What’s unique about this approved personalized therapy is that it was designed for a single individual. It’s an inspiring story.

A physician at the University of Massachusetts Chan Medical School tailored a CRISPR therapy for his brother, who has muscular dystrophy. His brother couldn’t qualify for any existing clinical trials for patients with the same disease due to his age… so this doctor at the Chan Medical School took matters into his own hands by starting a new clinical trial.

And what makes this even more interesting is that the therapy developed uses CRISPR in a way it hasn’t been used before.

Muscular dystrophy is caused by the body failing to utilize a portion of the genetic code. Patients with the disease do in fact store the right code, but it’s hidden… and their bodies just don’t know how to use it.

So the doctor plans to use a viral vector to deliver his CRISPR therapy directly to his brother’s cells. There, it’s designed to reprogram the cells so they know how to use the proper genetic code. If it works, the patient should experience a restoration of muscle proteins.

We’ve never seen this attempted before. And because it’s an in vivo therapy – meaning everything is happening inside the patient’s body – it’s much more challenging to pull off.

This is a landmark event for CRISPR and personalized medicine. If this works, we’ll see an intense focus on automating the process for producing personalized therapies like this. That’s critical to making these kinds of therapies accessible.

The best estimates suggest that this personalized CRISPR therapy costs between $2.8 and $3.5 million to develop. That’s not exactly reproducible at a population-wide scale.

But if the industry can automate most of the development process required to personalize a therapy, using artificial intelligence (AI), automation, and robotics, we’ll see prices drop significantly. It won’t be long until these personalized therapies cost six figures… and eventually drop to five figures.

That would not only make them accessible, but it would also almost certainly be covered by insurance. Depending on the disease, if the cost of a personalized cure is at or below the discounted cost of a lifetime of managing the disease, insurance companies will be incentivized (and possibly required) to cover the costs.

So I’m very excited to track this story closely. Positive results will rapidly accelerate the rise of personalized medicine.

As regular readers know, Las Vegas was one of the first places in the U.S. to experiment with autonomous ride-hailing services.

It started with a partnership between Lyft and autonomous driving company Aptiv. The two made self-driving cars available on the Las Vegas Strip way back in 2018. Originally, each ride featured a safety driver in the front seat. Years ago, I took a ride myself in one of these earlier versions.

That program evolved when Aptiv formed a joint venture with Korean conglomerate Hyundai to create Motional. This put Aptiv’s technology in Hyundai’s cars.

And now they just took the next step… Lyft and Motional revealed their next-generation self-driving car. Here it is:

Lyft and Motional’s New Car

Source: Lyft

As we can see, the new car is optimized to perform autonomous ride-hailing services. That’s because it is loaded with advanced sensors. They are on the front, on the sides, on the top, and on the back.

These sensors enable the car to map out its surroundings entirely. It knows what’s going on around it at all times.

Clearly, beauty wasn’t the primary goal of this design; it’s all about safety.

Lyft will use this car to provide fully autonomous rides in Las Vegas immediately. And starting next year, these rides will no longer include a safety driver. That’s how far the technology has come.

From there, Lyft plans to roll out this service in multiple U.S. cities next year. That’s when fully autonomous ride-hailing services will go mainstream.

What’s more, Lyft has worked hard to optimize its app for autonomous rides.

The company designed features in the app that will allow passengers to control certain things in the car right from their phones – such as unlocking doors and starting the ride. And the passengers can communicate with Lyft directly with the press of a button.

That’s a great feature that could enhance safety and comfort. And it will make autonomous rides more acceptable to a greater number of people.

So this is a big announcement for the autonomous driving industry. I look forward to seeing which cities Lyft expands into next year.

And as these autonomous services become more widely available, I encourage readers to try them out. It’s a fantastic experience and I think you’ll be surprised at how seamless and comfortable it is.

We’ll end today with an interesting development… For the first time ever, streaming TV viewing time has topped traditional cable. This chart tells the story:

As we can see, streaming has experienced a massive surge over the last few years to finally overtake cable.

As of July 2022, 34.8% of viewing time in the U.S. is spent on streaming services. That compares to 34.4% on cable TV.

This likely won’t surprise too many people. Perhaps the biggest surprise is that it hadn’t happened yet. But here it is… Streaming is officially king.

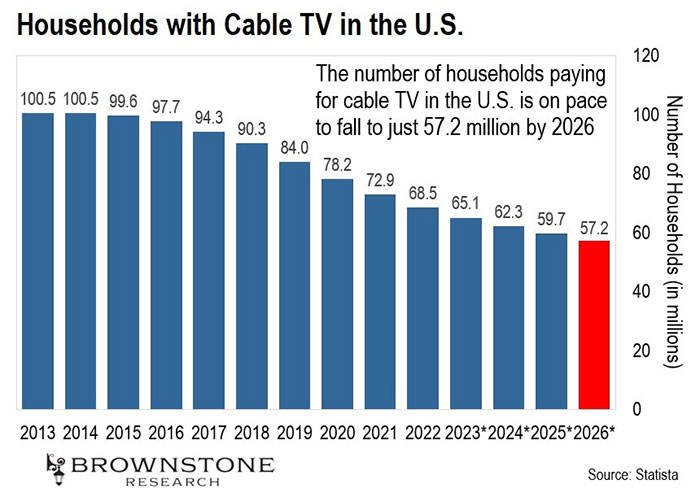

It’s been a painful decline for cable TV in recent years. And the number of U.S. homes paying for traditional cable is rapidly declining…

As we can see, the number of households paying for cable TV has fallen from over 100 million in 2013 to under 69 million. That’s a 32% drop.

And this decline will only accelerate in the coming years. Researchers estimate that just over 57 million homes will still pay for cable TV service by 2026. That represents a decline of 43% from 2013.

Some may point to the pandemic as the catalyst that set this trend in motion… But I don’t think that’s the case.

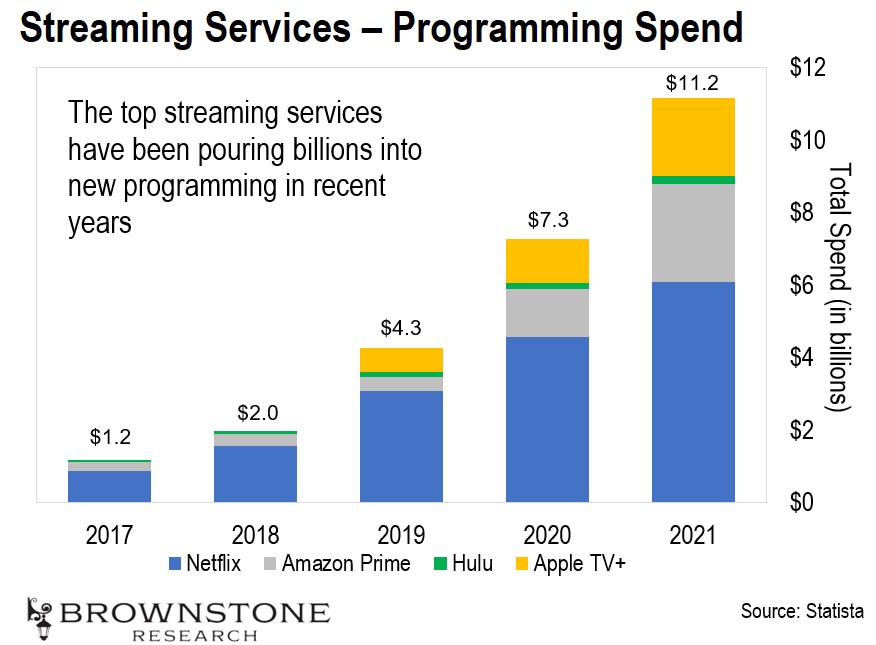

Streaming services have invested more and more heavily in programming and production in recent years. That’s led to an explosion of high-quality movies and TV series – all exclusively available on streaming services.

And with that, the top streaming service providers have been pouring billions into creating original content:

This is why consumers are cutting the cord at an accelerated pace.

We are now in the golden age of programming. Never before has more high-quality content been available to consumers. This has accelerated how we consume content.

No longer do we need a digital video recorder (DVR) in a set-top box at home. Streaming is so much more convenient. And it’s going to continue for the rest of the decade.

Here’s where it’s headed…

Eventually, cable TV programming will go away. These companies just don’t have the free cash flow to do what Netflix, Amazon, and Apple TV are doing with programming. They’ll primarily become a “pipe” to deliver internet access.

And even that might not last forever…

I finally broke up with my cable TV company last week. It was one of the happiest days of my life.

I had been paying through the nose for slow and not very dependable internet access for years with the worst customer service that I’ve ever experienced. Another company ran fiber lines down my street, and I jumped on the chance to make the switch. Now I have 1 Gbps speeds, upload and download, right to my house.

I had been paying through the nose for slow – and not very dependable – internet access for years… along with the worst customer service that I’ve ever experienced. Another company ran fiber lines down my street, and I jumped on the chance to make the switch. Now I have 1 Gbps speeds, upload and download, right to my house.

Ironically, this is something that I had nearly 15 years ago when I was living in Tokyo. Nonetheless, it was worth the wait. If any readers have done the same, I’d love to hear about it. Please write me with your story right here.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.