Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology.

Today, I’ll do my best to answer them.

But before we turn to our questions, I’d like to share a bit about what I’ve been up to with readers.

Over the past couple of weeks, I’ve traveled to 10 different cities across America, and I’ve visited almost 20 cities over the last three months.

Why? Because I’ve been investigating the fastest-growing technology trend… something I think will be the best investment opportunity of the next decade.

And I needed to see it for myself.

The good news is that those thousands of miles traveled have paid off. Through all of my “boots on the ground” research, I discovered that my predictions about this trend were too conservative, and the opportunity is far greater than what I had originally thought.

We are on the cusp of exponential growth in a key area of technology.

And if you’d like to see the footage from my travels… and watch as I pull back the curtain on this trend… all you need to do is attend my upcoming “Beyond Exponential” summit that is happening next Wednesday, October 21, at 8 p.m. ET.

It’s completely free to attend, and while you’re there, I’ll demonstrate to all attendees the one idea I’d bet everything on if I had to start over from scratch. You can reserve your place right here.

So please remember to mark that date on your calendars. I hope I’ll see you there.

Now let’s turn to our mailbag questions…

And if you have a question you’d like answered next week, be sure you submit it right here.

Let’s begin with a couple of questions on hydrogen fuel for vehicles…

Hi, Jeff, I recently read comments on building out electric vehicle (EV) infrastructure in America and the massive power requirements needed to support this. I am curious about your thoughts on hydrogen fuel cells as opposed to lithium-ion batteries.

– Kenyon C.

Hi, Jeff, I’ve been researching a little on hydrogen fuel, and it sounds to me like it would be a much better option than electric vehicles because hydrogen can get more mileage with more power, and it can refuel within five minutes just like you can at a gas station. Why isn’t there more interest in this direction? If they’re building infrastructure for electricity hookups, why can’t they build infrastructure for hydrogen?

– Joyce K.

Hi, Kenyon and Joyce. You’ve both touched on a very popular topic here at The Bleeding Edge. Many readers are eager to see the adoption of hydrogen fuel for our cars and trucks. And I am as well.

It may be a surprise to some, but we do already have working hydrogen cars. And they are attractive for a couple of reasons…

First, hydrogen is clean energy that doesn’t put out any emissions.

Second, hydrogen has more “energy density” than a typical lithium-ion battery in an electric vehicle. That means we can get more energy per unit of hydrogen than we can from an equivalent unit of energy from lithium-ion batteries.

But there’s just one problem. These vehicles aren’t very economical.

And hydrogen refueling infrastructure is also currently very limited. According to the U.S. Department of Energy’s Alternative Fuels Data Center, there are just 44 hydrogen fueling stations in the entire country. And 42 of those stations are in California.

Today’s hydrogen vehicles use hydrogen fuel cells. These cells need to be filled with pure hydrogen at a filling station. And the bigger problem is that hydrogen fuel is extremely expensive to produce.

According to the National Renewable Energy Laboratory, it costs $4.50 to produce a kilogram of hydrogen, which is the rough equivalent of one gallon of gas. That means we would see fuel prices well above $5 per kilogram of hydrogen.

Compare that to an average of $2.60 per gallon of gas in 2019.

And if we use fossil fuels to produce the hydrogen, we end up using more carbon than if we had just fueled our cars with normal gasoline. That negates its value as “clean” energy.

Clearly, until we find a way to make hydrogen fuel cheaply, and preferably without fossil fuels, we just won’t see major investment in the industry.

Lithium-ion batteries are so well established and continue to improve in energy density incrementally, year after year. They’ve continued to fall in price as well. It is very hard to make an argument to switch to hydrogen right now.

But there is an interesting early stage company that has developed a novel approach to producing hydrogen.

AlGalCo, based in Indiana, has developed a system called “Hydrogen on Tap.” This system actually produces hydrogen in real time.

I am happy to say that this tech was originally developed at my undergraduate engineering alma mater, Purdue University. AlGalCo licensed the tech from Purdue and has built a company around it.

The “Hydrogen on Tap” System

Source: Kelly Wilkinson/Indy Star/USA TODAY Network/Imagn Content Services

AlGalCo doesn’t use fuel cells. Instead, it installs cylinders that hold pieces of an alloy made from aluminum and gallium. When water drips onto this alloy, it causes a chemical reaction that splits the oxygen from the hydrogen in the water. Then the hydrogen is pumped directly into the manifold of the car.

That means this system produces hydrogen on the spot. As the name suggests, hydrogen is “on tap.”

And it’s completely clean. There are no emissions. The only byproduct is aluminum oxide, which can be recycled. So this approach has a lot of potential. And the device has already been approved by the Environmental Protection Agency.

The one downside is that this system takes up a lot of space “beneath the hood,” which results in a bulkier vehicle. For that reason, I don’t think we’ll see this applied to passenger vehicles unless the units significantly reduce their size. However, this is ideal for trucks and municipal vehicles where space and aesthetics are not a concern.

In fact, in April of this year, the city of Carmel, Indiana, became the first to retrofit some of its fleet vehicles with this technology. The mayor said the city would test how these first few retrofitted vehicles do, but he anticipates that they will buy more.

And AlGalCo is in talks with other nearby cities for similar deals.

So while we wait for better options in the passenger vehicle market, we can see that progress is being made in this area. I’ll be sure to keep my readers updated on any advances.

Next, a reader wants to know more about gallium-nitride semiconductors…

Hi Jeff, I am a loyal reader and subscriber to all your services. I enjoy reading every article and piece of analysis you post.

You mentioned several times about Moore’s Law, especially in the space of semiconductors. Just recently, I saw your analysis that mentioned how silicon photonics can improve the performance of chips dramatically. In some other readings, I am also aware that gallium-nitride is the new material that might replace silicon to make chips, which has super high performance and energy-cost savings.

A good example is NXP Semiconductors, which just opened a factory in Arizona to manufacture gallium-nitride radio chips for 5G. Do you think both silicon photonics and gallium-nitride will reset Moore’s Law, and if so, do you think both areas are great investment themes?

– Jiahua C.

Hi, Jiahua. Thanks for being a reader and subscriber. I’m glad you’re finding value in my research. The gallium-nitride (GaN) chips you’re talking about are a technology I’m extremely optimistic about.

Here’s an explanation for unfamiliar readers…

As a semiconductor material, GaN is 10 times faster than silicon. It can operate at much higher voltages and is a more efficient material to manage power conversion.

As if that weren’t enough, GaN provides better thermal performance – basically, it puts out less heat even at higher power levels. This is extremely important in electronic equipment.

GaN also allows electronic equipment to be designed with fewer components, which results in a smaller overall design. Fewer components and smaller design also mean less expensive products.

To sum it up, GaN is a far superior material for semiconductors used for power management than the materials used today. And it will be an essential material in transistors for the higher frequencies and thus higher power requirements of 5G technology.

That’s a key point. Whenever you see “GaN” going forward, just remember that it is an essential piece of the puzzle for 5G networks.

So why hasn’t GaN been adopted throughout the industry yet? One word: cost.

Until recently, GaN semiconductors were multiples more expensive than their silicon counterparts. In 2015, some of the first GaN products priced at or below competitive silicon products came to market. It wasn’t across the board, but it was the beginning.

I remember working with GaN technology 20 years ago. I’ve been following this trend ever since, and we have hit the inflection point.

When a developing technology has markedly higher performance benefits and can be manufactured at the same price as the incumbent technology… that’s when sales start to rocket.

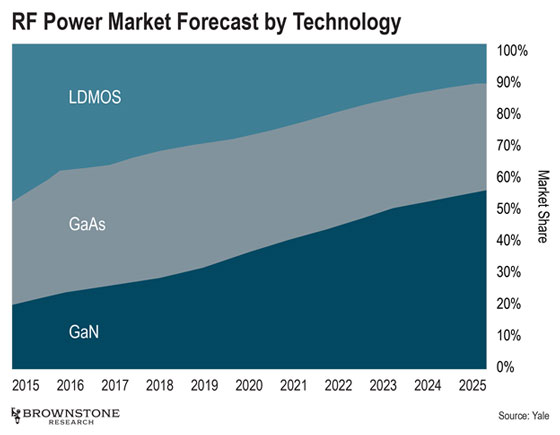

The market forecast below is a great visual representation of the trend that has already begun.

As of early 2020, GaN technology had the largest market share among the most prominent radio frequency (RF) power technologies – surpassing the current frontrunners, LDMOS (laterally-diffused metal-oxide semiconductor – this is silicon-based) and GaAs (gallium arsenide).

And by 2023, it will reach 50% of the total market. I believe it will happen before then due to dropping manufacturing costs.

And as these manufacturing costs drop, GaN technology will become the predominant radio frequency power solution. And that means we should be paying attention as investors, especially as the 5G rollout continues.

As for your question, Jiahua, Moore’s Law says that the number of transistors in semiconductor-integrated circuits doubles every 18–24 months. That, of course, increases computing power.

Moore’s Law is the reason we’ve enjoyed an explosion of computing performance over the last few decades. It’s the reason the smartphone in your pocket is more powerful than all the computers used to send a man to the Moon.

But in recent years, technologists have noted that Moore’s Law is slowing down. The doubling is now taking place about every two and a half years. As a result, the industry is looking for a way to keep Moore’s Law alive.

It’s important to point out that there is no real connection between GaN material technology and Moore’s Law.

In other words, GaN will not accelerate Moore’s Law. Moore’s Law is really speaking to semiconductor-manufacturing processes. Quite simply, it is the ability to place more and more transistors in a smaller and smaller space.

Semiconductor manufacturing is happening right now at 5 nanometers (nm), and bleeding-edge technology is already being worked on at 3 nm by Taiwan Semiconductor Manufacturing Company.

And when I think of Moore’s Law and computing power, I view the big jump as quantum computing. The use of quantum computers will result in Moore’s Law accelerating.

The doublings of computing power as a result of quantum computing will happen so quickly, measured in months, that we’ll probably have to name a new law to explain it…

I currently have a recommendation for a company perfectly positioned in GaN technology in our Exponential Tech Investor model portfolio. And we’re up over 103% since April 2019. Paid-up subscribers can find all the details here.

And if anyone would like to join us and learn about the bleeding-edge, small-cap companies I recommend in this service, you can go right here to find out how.

Let’s conclude with a question about which phones are best…

Greetings, I’ve been putting off buying new phones. When will it be safe to purchase new phones? Ours are on their last legs, so to speak, and I’d like to know which brands and models are safe to purchase.

– Fred K.

Hi, Fred. I’m happy to say that your patience in waiting to buy a new phone will be rewarded.

Why do I say that? Because the smartphone I’m most excited about… the one I’ve been waiting for all year… was finally just announced this week.

On Tuesday, Apple announced its 5G iPhone 12. In fact, it delivered four options: the iPhone 12, iPhone 12 Mini, iPhone 12 Pro, and iPhone 12 Pro Max. I actually told my readers all about the announcement on Wednesday.

The screens are better than ever before… the cameras are improved yet again… the new models are faster and more power-efficient than before.

But none of those features are what I’m most excited about.

All four versions of the iPhone 12 are 5G-enabled. And they can use the mmWave band 5G networks that Verizon is building out right now. Others will soon follow. That means we’ll have access to the lightning-fast speeds and extremely low latency that 5G can bring.

Not only that, but these phones have a number of important advances.

As just a few examples, the iPhone 12’s central processing unit (CPU) and graphics processing unit (GPU) combined are about 50% faster than those of any other smartphone. That equals faster results and a better experience.

Plus, this iPhone has a whopping 11.8 billion transistors. That means you’ll essentially be carrying around a supercomputer in your hand. It also has the first 5-nanometer CPU in any smartphone in the industry, so it’s faster and more power-efficient.

And Apple’s A14 chip has a neural engine capable of performing 11 trillion operations per second, and it has up to 70% faster machine-learning accelerators. That means this “supercomputer” can run artificial intelligence/machine learning software.

All of the above means that this is truly an amazing upgrade to our current phone models.

And here is why I’m going to make a specific recommendation for those ready to upgrade. I really recommend purchasing an iPhone 12 Pro (or Pro Max) because the Pro models include lidar (light detection and ranging) technology.

Lidar has the ability to accurately produce a depth map of any room or space that you are in… in just seconds. It is the key technology to unlocking incredibly realistic augmented-reality applications, which are going to proliferate when combined with 5G-network connectivity.

This is the future of wireless and mobility, and it is here now. Preorders for the iPhone 12 Pro start today and for the Pro Max on November 6.

But if that hasn’t convinced you, Fred, then there are other options on the market.

While I’m not a fan of Google’s exploitative data-collection practices, I understand that many people do use its products.

And for Android users, Google also just announced that its flagship 5G-enabled smartphone, the Pixel 5, will launch sometime this fall.

And in addition to the Pixel 5, a 5G-enabled version of the Pixel 4A will also be available this fall. Other smartphone manufacturers will likely follow with similar versions based on Google’s designs.

And even if subscribers don’t want to purchase a 5G phone right now, investors need to be paying attention. We are about to see a tidal wave of 5G devices hit the market, especially now that Apple and Google have joined the fray. It will catch everybody by surprise.

But for investors who see this early, there is a way to profit. How? Every single one of these 5G devices – hundreds of millions of them – will need an essential component.

And I’ve found the company that produces that component.

That’s why this is my No. 1 large-cap, 5G stock of the year. If any readers aren’t prepared for the 5G devices boom, I encourage you to get the details here.

That’s all we have time for this week.

If you have a question for a future mailbag, you can send it to me right here.

Have a great weekend.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. If you’d like to receive free VIP text alerts about my upcoming “Beyond Exponential” summit I mentioned above, you can go right here to enter your number. You’ll also receive exclusive bonus materials like training videos I’ve put together for investors. You can get all the details right here.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.