Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology.

Today, I’ll do my best to answer them.

Before we turn to our questions, though, I’d like to make sure an important event is on readers’ calendars…

In just over a week, I’ll be doing a deep-dive presentation into the booming non-fungible token (NFT) space. NFTs are producing some of the fastest gains in the history of the financial markets right now.

And we’re getting a glimpse of the future. This won’t just be a fad.

Instead, NFTs will develop as a key part of the blockchain and cryptocurrency ecosystem… and they have the potential to make early investors millions.

That’s why, on January 26, at 8 p.m. ET, I’ll explain all about the biggest opportunity I see in this space… and share the name of a coin I’ve never recommended before – one that I believe will benefit from this NFT boom.

I’ll also be doing a special giveaway that night. Attendees will have a chance to receive a free NFT sent directly to their wallet – but only if you’re there on January 26.

This NFT trend is only getting bigger, so please make sure you don’t miss out. To RSVP for this special event, simply go right here to sign up.

If you have a question you’d like answered next week, be sure you submit it right here.

Let’s begin with a question on robots taking away jobs:

If they make too many robots that are taking away people’s jobs, then what are we humans going to do?

– Marko L.

Your technological advancements are going to be the downfall of this country. Taking thousands of truckers’ jobs away only to replace them with these automated vehicles! You see this as such a great thing! I see this as a major downfall to America!

What do you expect people to do for work when all of their jobs have been replaced by automation? This is not a world I even want to be in. It sounds like something out of an insane sci-fi movie!!

– Kathy R.

Hi, Marko and Kathy – thanks for writing in. I’ve grouped your questions together since they covered the same topic.

Automation taking away people’s jobs has long been a major fear regarding this technology. And you’re right – automation will affect the world we live and work in. Self-driving vehicles, contactless shopping, and factory robotics will all influence job markets globally.

Some jobs will go away. But rather than completely disappearing, many of them will evolve. The nature of work in some fields will change.

Yet remember, these kinds of transitions have happened many times throughout history. The shift to automation is similar to the Industrial Revolution.

During that period, steam power and mechanization automated many of our repetitive, physical tasks. That led to a dramatic change in the workplace. Machines took over many of the grueling jobs humans weren’t well-suited for.

And many people had similar fears to the ones that you’ve both expressed.

But rather than the doom and gloom of mass unemployment that many expected, the opposite happened. The Industrial Revolution caused an explosion of productivity and economic growth that ultimately created far more jobs and opportunities than were lost.

I believe we’ll see a similar occurrence with this new “automation revolution” taking place now. We’ll need millions of people to construct bleeding-edge factories with new technology… as well as others to service and maintain the equipment.

This will require various skill sets, from construction workers to those with advanced degrees in robotics.

So my prediction is that the old days of going to school, studying one thing, and staying in that line of work for the rest of our lives are over.

Instead, we’ll need to think about our education and skills as things that evolve and grow over time. We’ll need to proactively work at these things. We’ll need to expand our skills, preferably into areas of the economy that are experiencing growth.

That requires hard work, effort, and our time. But in a world where the rate of technological development is accelerating, we’ll have to maintain a more flexible mindset about work and developing our skills throughout our careers.

There will, of course, be a part of the workforce that will simply refuse to change or upgrade their skills, as we’re experiencing right now. The U.S. has millions more job openings than people willing to go back to work.

That’s why some call this moment the “Great Resignation.” Many are simply deciding that they don’t want to go back to work. That’s their decision, and every decision has consequences.

This labor shortage has brought automation into even greater focus as a result. More and more companies are turning to automation to fill roles that people are reluctant or unwilling to do.

So, automation is changing the landscape of our world even faster than we anticipated. And right now, automation as a whole isn’t taking human jobs away… it’s filling the gap of the shortage in human labor.

Ultimately, we’re entering a world of abundance. With automation and robotics, we can avoid repetitive and physically demanding work.

And Kathy, I’d like to give you a reason to be optimistic about these changes. Aside from automation helping to solve the labor shortage crisis, it will also result in less workplace injuries and less deaths. Consider this… 94% of all automotive accidents are the result of human error.

On top of that, so many new jobs are going to be created. We’re going to need a lot of humans to employ, manage, and maintain these new technologies, like advanced manufacturing plants, nuclear fusion, genetic editing, 5G and 6G wireless networks, self-driving cars and trucks, and so much more.

This is the direction we’re heading. And I’m confident we have a lot to look forward to as the world adapts to these changes.

Next, a reader wants to know more about the risks of electric vehicles (EVs) in snowy weather:

Jeff, note that in the recent Snowstorm Frida in Virginia, vehicles were stranded for over a day. How do you keep warm in an EV? Would this run out the battery? EVs on long stoppages of this kind may have to be towed. Gas vehicles on the other hand, if they run out of gas, can have someone bring them gas. How will EVs be able to cope with these situations?

– Valsin M. F.

Hello, Valsin, and thanks so much for writing in. This is a timely question with the recent snowstorm on many people’s minds. It was incredible to see the pictures of the highways that turned into parking lots. It reminded me of images from The Walking Dead television show… only in winter.

Ironically, I read some stories of how people stranded in Teslas were able to keep warm in their car through the debacle. It is possible, but in reality, the answer would really depend on how full the batteries are in any given car.

The same would be true for an internal combustion engine (ICE) car – its ability to stay warm would depend on how much gas is left in the tank.

For perspective, a full battery should keep the car operational for roughly three days – and while many drivers won’t have a totally full battery, an EV may well run longer than a gas car in that situation.

A gas car burns roughly half a gallon an hour while idling, and the average tank is about 15 gallons. A full tank in that case would only last about 30 hours.

Likewise, an EV would be able to keep you pretty warm in a snowstorm as well. Most EVs have electric seat heaters. While this isn’t exclusive to EVs, an EV seat heater uses around 60 watts per seat. A full EV battery could support that energy load for around a month.

Teslas are an exception to this since their seat heaters require a car’s computer to be on. But even with that higher power load, a full battery could last about a week.

Even if you decide to heat the whole cabin of the EV rather than just the seats, an EV can still do so more efficiently than an idling gas vehicle. With an EV, the driver can adjust the heat to a low setting and use less power.

Newer EVs also use heat pumps that can be as much as 400% more efficient at heating the car, which will let them keep passengers cozy even in a snowstorm.

All that being said… We should also keep in mind that cars getting stuck in a snowstorm for more than a couple of hours is a rare event in most parts of the world. And with weather forecasting, most people can anticipate inclement weather to some degree.

Aside from all that, we should all keep in mind that anytime the weather is inclement, it is always smart to keep a full tank, or a full battery, before we head out on a journey.

And in the event that an EV does run out of power, I have already seen the emergence of services that provide the delivery of an electricity boost, just as there are services to bring cars a few gallons of gas. This will obviously become far more common with the proliferation of EVs.

Thanks for writing in with this timely question.

Let’s conclude with a question about the timeline for special purpose acquisition corporations (SPACs):

I have invested in many of the recommended SPACs but have yet to make any money. How long does this take??!! Please give us an update. Thank you!

– Mary H.

Hi, Mary, and thanks for writing in.

As some background for new readers, SPACs exist for one purpose: to combine with a private company to take it public. That allows regular investors the rare opportunity to essentially invest in a company before it goes public, which is when the greatest gains are possible.

And one of the special features of SPACs is their deadlines. When each SPAC is created, it has a limited time window to perform a reverse merger with a promising private company.

Usually, that time window is 18–24 months.

If a SPAC doesn’t complete a reverse merger by its deadline, then it must return all of the funds it raised during its own initial public offering (IPO) to shareholders, minus a small management fee. This is nearly always about $10 per share.

In Blank Check Speculator, we call this our “money back” guarantee.

To answer your question, Mary, it can sometimes take up to two years for these investments to bear fruit, but it’s very unusual that it takes that long. This is especially true for high-quality SPACs with great sponsors.

It’s important to know that every SPAC is incentivized to find a business combination as quickly as possible. Once they’ve had their IPO, the sponsors and investors in the IPO only do well when the SPAC affects a promising business combination, so naturally they want to do so quickly.

For high-quality SPACs, the average time to find a business combination is usually around six to eight months, but it can happen in as little as three.

For Blank Check Speculator subscribers, I share this timeline in every buy alert and tell readers exactly what day a SPAC’s money-back deadline is. That way, we can keep an eye on the calendar and know how much time is left. And typically, once we hit the six-month mark, we can expect that there will be an announcement right around the corner.

It’s important to mention that until our SPACs announce their reverse mergers, their share price will trade fairly flat. The price will usually stay near $10 per share, which represents the value of the money the SPAC holds in its trust.

So please don’t be concerned if it seems like some of our investments aren’t doing much right now. This is normal during the period when the SPAC sponsors are working toward affecting their business combination.

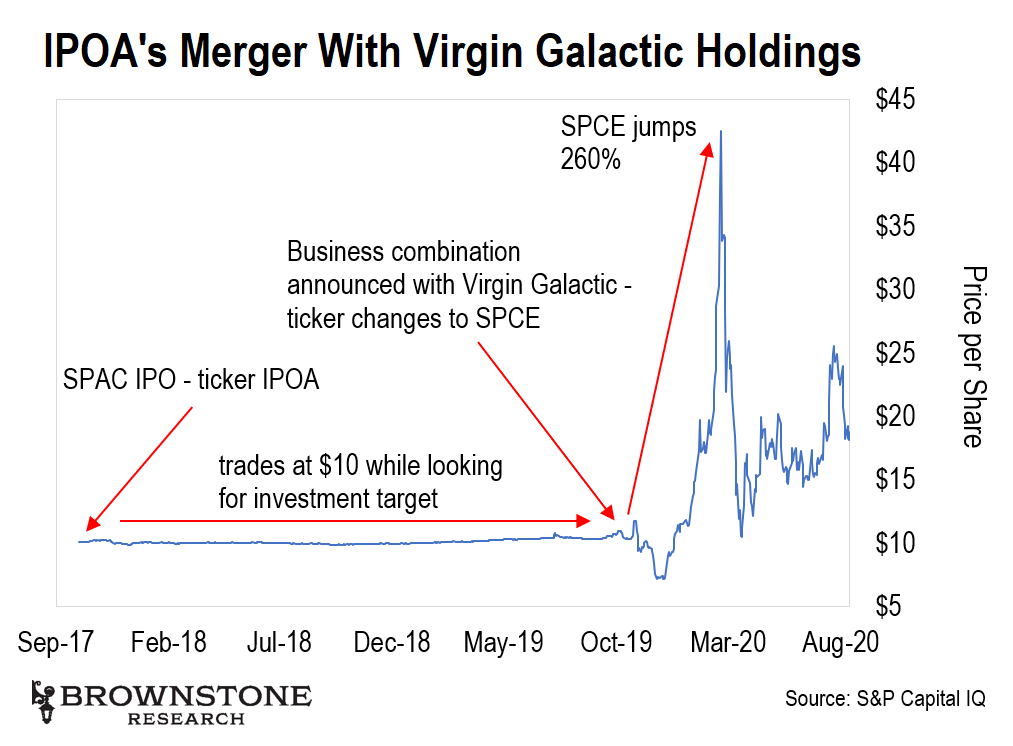

Remember, as I’ve shared before, once our SPACs announce their deals, the share price can move very quickly. Look at the chart below for just one example.

As we can see, the SPAC IPOA traded nearly flat from August 2017 through October 2019. Then, in the couple of months following the reverse merger announcement, the share price rocketed up 260%.

The warrants went up even further over that time frame – an amazing 1,371%.

So we simply must be patient while we wait. And we have the added comfort that there is very little risk with our investment because there is the money-back guarantee.

The Blank Check Speculator research service only launched about a year ago. We’ve started seeing several of our companies begin announcing their reverse mergers. And we’ll no doubt see more of them make their announcements in the coming months… Our portfolio is like a coiled spring.

If any readers would like to learn more about the opportunities SPACs offer, please go right here for more information.

That’s all we have time for this week. If you have a question for a future mailbag, you can send it to me right here.

Have a good weekend.

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.