Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology.

Today, I’ll do my best to answer them.

If you have a question you’d like answered next week, be sure you submit it right here.

Before we turn to our mailbag, I’d like to ask us an important question: How do we turn $1 into $100?

In the world of equity investing, we do this with stocks known as “100-baggers.” As the name suggests, these are stocks that turn every one dollar invested into one hundred dollars. An old colleague of mine Christopher Mayer even wrote a great book on the subject.

These stocks aren’t always easy to find. And they don’t come around every day. But do they exist? Absolutely. We can see this for ourselves.

In May of 2003, Amazon (AMZN) traded for around $30 per share. Today, that same stock trades north of $3,100.

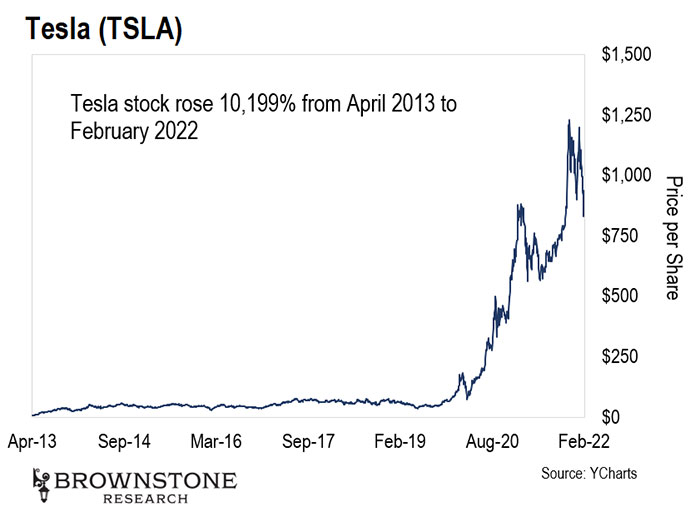

Or what about Tesla (TSLA)? As recently as April of 2013, the stock traded for a split-adjusted $9 per share. One share of that company now goes for around $900.

Here’s one more, Netflix (NFLX). Even with the recent collapse in the share price, NFLX trades for around $400 per share. As recently as January of 2009, that same stock was $4.

All three companies turned $1 invested into $100. All three companies delivered a small fortune to savvy investors.

Of course, I can probably guess what we’re thinking: Nobody could have possibly predicted those companies would become 100X stocks. But that’s simply not true.

In the world of technology investing, these stocks tend to have three things in common.

They are incredibly disruptive: These companies are applying leading edge technologies to offer a product or service that is truly unique and revolutionary.

They had a plan to “scale”: All three companies had plans to grow and expand into their respective markets in a profitable way.

They are small-caps: To return 100X, investors had to take a position when the company was in its early stages, when the upside potential was highest. That means investing in small-capitalization companies.

And while the recent volatility might have many investors anxious, I’d point out that all three examples survived and even thrived through past periods of market volatility.

The point I’d like to make is that turning $1 into $100 doesn’t happen every day, but it does happen. As investors, we simply need to know where to look.

That’s why on February 16th, I’m hosting a special investing summit to show how we’ll find these stocks. We’re calling the event The 100X Plan.

As the name suggests, I’ll reveal my strategy for identifying the stocks that return 100-to-1. And all of the investments I’m recommending have the same qualities as the “100-baggers” I shared above.

This opportunity I see didn’t exist even just a few years ago. But something fundamental has changed. It has to do with the pandemic and the economic lockdowns, but not in the way we might think.

The way we work, invest, and save will change in the months and years ahead.

Most people will be caught off guard. But I believe prepared investors will have the chance to find the “100-baggers” of the next decade. To get the full story, I encourage you to reserve your seat for the “100X Plan” by going right here.

Now, let’s turn to our mailbag.

Let’s begin with a question on this “move-to-earn” project:

Hi, Jeff – Another Brownstone Unlimited member here, just appreciating The Bleeding Edge today. While most of the subject matter you come up with is very impressive, to say the least, I was very intrigued by the NFT talk and the STEPN App.

My wife is retired, and I am semiretired, and we walk quite a bit. I naturally got to thinking, why not get paid for it? My wife heartily agreed. I cannot find the STEPN App, though.

You indicated that they had a $5 million raise and that this is a perfect example of what is to come. Yet it kinda sounds like it is available now? Also, I presume it can be linked to a bank account like most wallets, and should one wish to sell some of their GST coins, they could do so?

Again, thanks for the great work. Regards,

– Paul M.

Hi, Paul, and thanks for being a lifetime subscriber. Especially if we regularly walk, jog, or run as a healthy habit, the STEPN app is a great addition to our activity.

For readers who missed it, STEPN is a Solana-based project that uses our smartphone to track and confirm the distance and time we spend walking, jogging, or running.

Users simply buy or rent non-fungible token (NFT) sneakers to use the app. STEPN then awards the user with its native cryptocurrency, GST, for their healthy behavior.

This is an evolution of the “play-to-earn” model, where gamers can earn rewards for participating and achieving milestones in Web 3.0 games.

These rewards aren’t pocket change, either. One of our Brownstone team members downloaded the STEPN app and is making around $200 worth of GST per day.

He had to purchase some sneakers up front for several hundred dollars, and he has been walking a lot. But the return on investment has been pretty fantastic already since I first wrote about STEPN.

Users can sell and turn their GST earnings back into fiat, spend them on more NFT sneakers within the STEPN app, or exchange them into another cryptocurrency.

Right now, STEPN earns fees of 4% on marketplace transactions, 6% on sneaker minting, and 8% on sneaker rentals. That enables it to pay out these rewards.

And users also benefit from the appreciating value of their in-game assets. The GST crypto and NFTs will increase in value as more people get involved.

The app has been in beta until recently, which may be the cause of any difficulties finding it. Yet readers can now find it in the Apple App Store and the Google Play store. You can go to the website here for the download links: https://stepn.com/.

This is a glimpse of the future… 2022 is when we will see more and more of these kinds of applications really take off.

And Paul, once you and your wife get to STEPN, we’d love to hear back from you about how much GST you’re earning.

Next, a reader wants to know more about risks in Taiwan:

Hello, thank you, Jeff, for the wonderful insight and for sharing your passion for investing in life-changing technology trends. I am an Unlimited subscriber and have truly gained considerable knowledge as a result of this subscription.

I had a question regarding the potential conflict in the years ahead from China and how a takeover of Taiwan would affect the semiconductor landscape. Given the geopolitical events unfolding and the U.S. weak foreign policy position, I see it as a matter of when, not if, China will take over Taiwan.

Do you agree, and should we position our portfolio for such an outcome? It is the reason I have held back taking a position in TSM, and it also would be a threat to many of our Near Future holdings.

I wonder how quick it would be to switch manufacturing to the U.S. Obviously companies are preparing for it, but I wonder if it will be too late. Thanks.

– Nicholas P.

Hi, Nicholas, and thanks for being a subscriber and for the kind words. You’ve definitely spotted a potential trouble zone. This topic is something that I’m keeping on my radar.

The relationship between Taiwan and China is complex and has been a concern for decades. And the semiconductor shortage we’ve been facing has highlighted these tensions even further.

This is important because semiconductors are used in many different industries. They are the “brains” of all electronics. The U.S. government has referred to computer chips as “essential to modern-day life.”

And that means any trouble in Taiwan would have significant ripple effects.

Many readers may not realize it, but the U.S. only makes about 12% of the world’s semiconductors onshore despite leading in chip design and intellectual property (IP).

Most semiconductor manufacturing is offshore, with the majority being in a handful of countries in Asia – specifically China, Taiwan, South Korea, Japan, Singapore, Malaysia, and, to a lesser extent, Thailand. The decisions to manufacture in the region were entirely driven by the historically low labor costs.

Taiwan Semiconductor Manufacturing Company (TSM) makes about 92% of the world’s most advanced semiconductors. It also makes around 60% of the less advanced chips our cars need.

In fact, TSM’s chips are in our smartphones, watches, laptops, game consoles, and much more. Without them, these products simply couldn’t be manufactured.

Additionally, TSM and Samsung are currently the only foundries capable of making bleeding-edge, 5 nanometer (nm) chips. TSM is even gearing up to produce 3 nm chips in volume in the second half of this year.

One research firm estimated that other countries would have to fork over $30 billion a year for at least five years to even have a chance of catching up to TSM’s technological lead.

So if Taiwan were to be taken over by China, the ramifications for the global economy and stock markets would be devastating. Taiwan is absolutely critical to technology and manufacturing supply chains.

And it’s not just TSM… Other Taiwan-based companies are key suppliers and manufacturers for the semiconductor industry as well.

If companies like Apple, NVIDIA, Advanced Micro Devices (AMD), Qualcomm, and others can’t get their chips from TSM, the market would collapse.

I’ve been to Taiwan more times than I can remember. Taking a flight from Tokyo’s Haneda airport to Taipei was as normal for me as a flight from Chicago to San Francisco.

A few times, I even made a few day trips to Taiwan when my schedule was particularly busy. They were long days, but it was possible to do it with the first flight out and the last flight back.

Taiwan is a fantastic place, and I always enjoyed my time there. It has an innovative business culture, a good work ethic, and it has a beautiful culture with very close ties to Japan.

The world needs Taiwan to continue to thrive and innovate independent from mainland China. The systemic risk to global production will simply be too large otherwise.

The bad news is that there has never been a riper time for China to make a move. The current U.S. administration is demonstrably weak on China at best.

Taiwan is a prize that would bring more wealth, economic growth, and outright power and control to China. It would have a chokehold to extract whatever it wanted from countries around the world.

This is why it’s so critical that manufacturing returns to a decentralized structure.

As one piece of reassurance, though, TSM understands the risks.

It’s in a mad scramble to diversify its manufacturing base outside of Taiwan as quickly as it can. It’s the same reason that it announced a major new manufacturing plant in Arizona and another in Japan.

We should expect more of the same to come.

As for our investments in this space, we’ll certainly keep an eye out if any signs of an imminent move occur. With that said, I don’t think that China would cause any major disruptions in the event of a takeover or assertion of administrative control.

I was in Hong Kong at the time of the British handover to mainland China. Many were fearful of what might come once the handover was complete.

Ironically, they were correct in their concerns, as we have seen. But they were wrong about the time frame. China took its time over the course of more than two decades to slowly and methodically take complete control and take away freedoms. This is a slow, methodical process that continues to unfold today.

In other words, the world will have several years to recalibrate in the event that China moves to take control of Taiwan. Either way, we’ll adjust our investment strategies as the world shifts and evolves.

Let’s conclude with a question about metaverse real estate:

Hello, Jeff, love your newsletters. I am a lifetime Unlimited member.

Just wanted your opinion on metaverse real estate. I heard that it will be more like a coordinate that takes you to a certain spot. It won’t be like walking around on the street looking at shops and buildings. Is there any truth to that?

If so, does this put a different strategy on buying things like metaverse REITs [real estate investment trusts]? Thanks, Jeff.

– Mark V.

Hi, Mark – thanks for writing in with this question and for being a subscriber. I’m always glad to see my readers thinking critically about new technologies like metaverses.

Right now, metaverse real estate is in its earliest stages of growth. Yet ultimately, it will change how we shop, communicate, work, and entertain ourselves.

At a high level, a metaverse is a virtual world where people can go and do many of the things they would otherwise do in the real world. Metaverses today have property rights, businesses, live events, and robust economies.

Metaverse land is ripe for development, and it is already becoming incredibly valuable. These worlds will have a variety of business ventures, shops, properties, and entertainment venues.

As just one example, Domino’s Pizza has already opened up shop in a metaverse known as Decentraland. Hungry users in the metaverse can stop by the Domino’s storefront, place their order, and have a pizza delivered to their front door in real life.

Domino’s Decentraland Storefront

Source: United Metaverse Nation

This is not some project that might happen in the future. This is something you can do right now. Here, we have a real business that literally “set up shop” in a digital metaverse.

And to return to your question, there will likely be a variety of experiences within different metaverses. In some metaverses, we will wander and find our way from place to place.

There may also be ones where we can only “teleport” to specific locations rather than meandering through the virtual space.

The beauty of metaverses is that there will be many of them, and they will be able to specialize for different audiences and interests.

And regardless of the precise experience we have, we can be sure many promising metaverse investments are appearing, whether they are REITs or projects developing a metaverse.

And to answer your question more specifically… No. Whether it is a small metaverse we can “walk” around or one where we teleport from town to town or coordinate to coordinate, it won’t change the investment strategy.

Just like in the real world, the most valuable digital real estate will be located near areas of interesting economic, cultural, or social activity.

And the beauty of metaverse technology is that we don’t have to spend the time to drive or fly to get to where we need to go. Everything will happen in an instant.

If any readers would like to learn more about some of those opportunities on my radar, you can go right here for the details.

That’s all we have time for this week. If you have a question for a future mailbag, you can send it to me right here.

Have a great weekend.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.