Seismic Shifts Ahead

We’re going to make sure that you are well prepared for the seismic shifts that are right around the...

With the media continuously harping over oil prices, we might think Big Money is focusing only on the energy sector right now. In reality, it’s actually paying a lot of attention to one key sector…

|

Tensions between Russia and Ukraine have taken control of the news. Understandably, the war has grabbed nearly every headline.

And when the media does shift its attention, it’s to one thing… oil prices.

The conflict in Eastern Europe has tied up Russia’s oil refineries with sanctions and fears of embargos. And last week, President Biden announced a ban on the imports of Russian oil and gas.

As a result, gas prices have already climbed over 50% since this time a year ago. The national average has reached all-time highs of $4.32 per gallon.

In other words, the American consumer is feeling the strain at the pump.

Yet while it might be easy to fixate on gas prices, there’s something much bigger happening behind the scenes right now… another impact that the war is having on a completely different sector.

And the mainstream media isn’t talking about it yet.

That means we have an opportunity as investors to get into position before the masses…

Hi, I’m Jason Bodner, editor of Outlier Investor. Here at Brownstone Research, I dig into data to find companies I call “outliers.”

They have traits like outstanding earnings… growing profits… and low debt.

And critically, I spot when “Big Money” – such as hedge funds and institutional investors – is buying them. When Big Money starts piling in, we pay attention… because their actions can move markets.

In fact, I built an AI system to track all these different factors for me and my readers.

And this system also can point us to which sectors Big Money is interested in.

That’s where today’s essay comes in…

While we might think Big Money is focusing only on the energy sector right now, it’s actually paying a lot of attention to one other area…

This isn’t the first time we’ve seen conflict between Russia and Ukraine.

We saw similar patterns back in 2014 when Russia annexed Crimea. At the time, it was the southernmost part of Ukraine that served as a vital shipping port for moving oil in and out of the Black Sea.

Back then, we saw oil prices spike up to $105 a barrel. At writing, prices have dropped back down to around $103 per barrel after spiking as high as $123.

But high oil prices and a war raging may not even be our biggest problem yet.

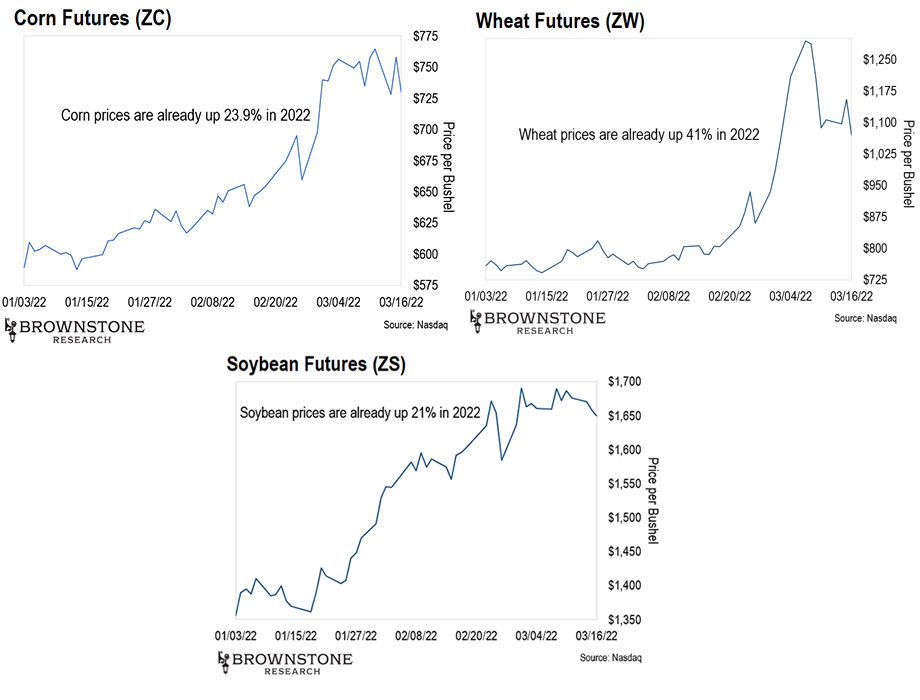

Prices for other commodities are also shooting through the roof. Everyday necessities like wheat, corn, and soybeans are all selling for sky-high prices.

Some readers may not know Ukraine is often referred to as the “breadbasket of Europe.” And its reach can be felt worldwide.

Each year, Ukraine cultivates over 123,000 square miles of farmland. That’s a little over the size of the state of New Mexico.

And since Russia’s invasion of Ukraine began, prices for some of its biggest exports have risen double digits.

This year alone, corn prices have risen 23.9%, wheat prices have gone up 41%, and soybeans are up 21%.

Corn is at its highest price since 2012, excluding a brief stint during the COVID quarantine. The same is true for soybeans. Meanwhile, wheat is at its highest price since 2008.

And things are looking like they’ll get even more expensive. Russia and Ukraine together supply 25% of the world’s wheat and over 50% of the world’s sunflower products.

With war tearing through the country, Ukrainians are focused on fighting, not farming.

This could lead to a food shortage sweeping across Europe later this year. Likewise, it could affect countries in Africa, which spent $4 billion on Russian imports in 2020… And 90% of that was on wheat. And some Asian countries are already feeling the impact due to upset shipping of corn for animal feed.

The ripple effects will likely even reach us here in the U.S. this year.

At the very least, we should expect prices for these agricultural products to stay elevated for a while.

And I’m not alone in seeing this possibility…

Recently, Big Money has been pouring into agriculture.

Due to the war raging in Eastern Europe, now is a strategic time to invest in agricultural commodities.

And one ETF in particular has caught my eye – the Invesco DB Agriculture Fund (DBA). This ETF holds futures on coffee, corn, sugar, soybeans, and cattle, among other things. Futures contracts allow the buyer to bet on the future price of a commodity or other security.

As I mentioned above, Big Money is moving into the ETF. And almost immediately following Russia’s invasion of Ukraine, DBA jumped nearly 5%. Year to date, the ETF is up over 9%.

And I expect this ETF will continue to go up as prices rise, especially if the war in Ukraine becomes protracted.

While we’ll hope for the best on that front, building a position in the agriculture sector could be a safe bet to protect ourselves from higher prices at the grocery store – and gas pump – this year.

Talk soon,

Jason Bodner

Editor, Outlier Investor

P.S. I know markets can seem uncertain right now. We’re in a period of higher volatility… and many of us are feeling it in our portfolios.

That’s why I continue to work hard to provide my readers with good data to help them navigate the current circumstances. Despite the geopolitical situation, inflation, and other fears, my system will help us profit over the long run.

If anyone would like more information about how my Outlier Investor research service works, please go here for more details.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

Read the latest insights from the world of high technology.

We’re going to make sure that you are well prepared for the seismic shifts that are right around the...

After decades of hesitation, the tide has finally turned. For the first time in a generation, global institutions, governments,...