|

Human ingenuity never ceases to amaze me. Take the recent case of the “heartbeat fish,” courtesy of scientists at Harvard and Emory universities:

[Researchers] have developed the first fully autonomous biohybrid fish from human stem-cell-derived cardiac muscle cells. The artificial fish swims by recreating the muscle contractions of a pumping heart, bringing researchers one step closer to developing a more complex artificial muscular pump and providing a platform to study heart disease like arrhythmia.

Harvard and Emory’s Heartbeat Fish

Source: Harvard: Michael Rosnach, Keel Yong Lee, Sung-Jin Park, Kevin Kit Parker

It’s amazing how far we’ve come.

Human heart cells just made a fully autonomous fish that swims with the beat! Besides being really cool, it’s an important step toward better heart treatments in the future.

And that’s only the latest in a string of discoveries…

About 100 years ago, the Spanish flu pandemic killed 50 million people. There were no vaccines or antibiotics for those who became ill.

Fast-forward to COVID-19, and we created novel vaccines and therapies in record time. This saved lives and kept people out of hospitals.

And while we often take it for granted, we’ve nearly eliminated diseases like polio, measles, and mumps with vaccines and treatments.

Just think of where medical science will be in the decades ahead.

This is very exciting, as many of us will live longer, healthier lives thanks to these innovations. And as investors, there are many great opportunities for us to profit as the future of health care takes hold…

Today, there are companies working on genetics, advanced medical devices, artificial organs, and even anti-aging treatments.

Just a few weeks ago, I discussed how we’re using artificial intelligence (AI) and predictive analytics to employ preventive treatments. And there is so much more.

The health landscape in future generations will look completely different than it does now, just as today’s is different from the centuries before. It may seem like science fiction, but it’s not too hard to imagine fully functional bionic limbs, like Luke Skywalker at the end of The Empire Strikes Back.

In fact, there are already multiple projects in place. MIT published research last year about a new technology that uses magnets to help control a prosthetic with muscle movements.

Also in 2021, Cleveland Clinic researchers developed a bionic arm that uses a brain-computer interface to provide a sense of touch and refined movement.

With these kinds of innovations, the future of medicine will look radically different… We could become near-ageless wonders, free of disease, with vitality and longevity hard-coded into a new human operating system…

And there are real companies working on these kinds of health applications.

As you can imagine, some of them grow to dominant positions. Early investors in these kinds of firms win big. By getting in early on potential “disruptors,” we have the chance to achieve incredible profits.

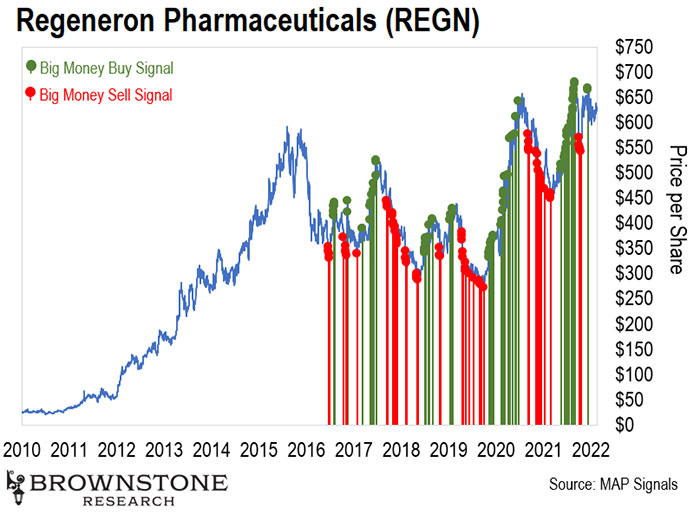

One such example is Regeneron Pharmaceuticals (REGN), a biotechnology firm making treatments for serious diseases ranging from cancer to rare autoimmune disorders.

In 2010, it traded around $20–30 per share. Today, it sits north of $600 per share.

Another is PerkinElmer (PKI). This is a laboratory testing and life science research company. Just five years ago, it traded in the $50 range, and now it hovers around $200.

But it can be difficult to choose the winners from among the many companies working in this space.

Many early biotech companies wither away or are bought up instead of returning hundreds or thousands of%.

So what’s the best way to invest in this trend?

One way to avoid placing our bet on a single company is to invest in an exchange-traded fund (ETF) in this sector.

Some ETFs focus purely on biotech and innovation. Others even refine their holdings to specialize in specific industries within health care.

A couple of popular examples are the iShares Biotechnology ETF (IBB) and the ARK Genomic Revolution ETF (ARKG).

Investing in these means owning pieces of multiple innovative health care companies. It’s less volatile than holding individual stocks and gives broader exposure to the biotechnology space.

Look at some of the top holdings:

IBB and ARKG are two ways to position ourselves for the future of health care. These ETFs hold companies that could redefine health in the future. Some of them could be big winners down the road too.

And if you’re like me and believe we are only in the infancy of human health care, then now is a great time to invest.

But if you want to target the specific companies that could be the next Regeneron or PerkinElmer, then my Outlier Investor research service may be for you.

There, I dig into individual companies to find the best of the best. I find companies with growing earnings and sales, good technical setups, and institutional buying. And my proprietary AI system tells me which ones hold the best potential.

We currently have one company in our portfolio focused on the pharmaceutical and life sciences industry that’s up 78% so far.

If you’d like to learn more about Outlier Investor, you can go right here for the full story.

The health care landscape is rife with innovation and full of need. We’re experimenting with genetics, can get cancer screenings through the mail, and now have bred a “heartbeat fish.”

The future of human health will be a phenomenal growth industry for investors who have the foresight to position themselves now.

Talk soon,

Jason Bodner

Editor, Outlier Investor

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.