Dear Reader,

Longtime readers know I’m always looking for an edge… a way to bring life-changing gains to my subscribers’ doorsteps. And one topic I am passionate about is making early stage technology investing available to all investors.

Right now, most private investments are limited to accredited investors, high-net-worth individuals, and venture capital (VC)/private equity firms. Because of that, it is a world that very few people know anything about.

That’s why I’ve spent the past several years digging into this space… hunting for new ways investors can level the playing field.

As a part of that, I’ve done lots of “boots on the ground” research. My personal network spans the globe, and my industry contacts range over just about any sector in high tech we can think of. And I’m always in learning mode…

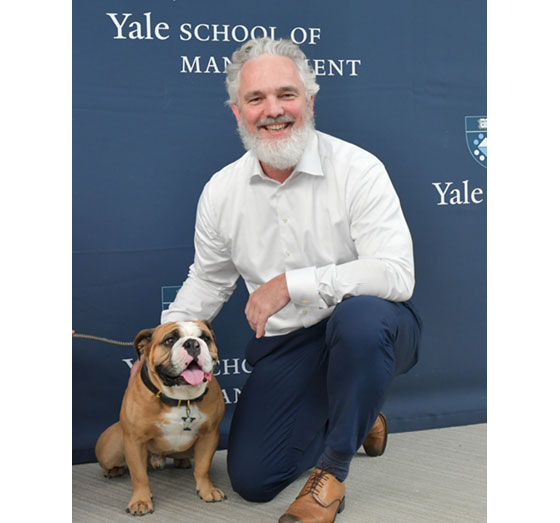

In 2019, I celebrated turning 50 by going back to school. I was admitted into Yale University’s School of Management for postgraduate business studies for a 10-month program. I graduated that October. It was one of the best things I’ve ever done.

Here I am on graduation day with Handsome Dan, the university mascot.

Jeff graduated from an executive leadership program at Yale University’s School of Management

I regularly attend the best universities in the world for continuing education and professional certificates. It keeps me on my toes and ensures that my network continues to grow. And I’m always generating new ideas.

In February 2020, I attended an invite-only weeklong class at the University of California, Berkeley, School of Law, and earned a professional certificate. Go Bears!

Jeff on campus at UC Berkeley School of Law

It was a great week. We dug deep into early stage investing and many of the nuances, both business and legal, that affect these kinds of investments.

Now, I’m not telling you all this to “brag.” It’s true that I find these studies very rewarding. But I also do it to benefit my subscribers.

Being on “the inside” of conversations around high technology and early stage investing allows me to pass on insights to my readers. These are topics that 99% of investors would never have the chance to learn on their own.

And during my travels, I uncovered something important…

I’ve been on a personal campaign to find a way to empower non-accredited investors to gain access to the highest-reward asset class in the world – private technology companies.

It is unfair that our government and the Securities and Exchange Commission (SEC) are okay with non-accredited investors literally gambling (something that has a nearly 100% certainty to lose money over time). But they don’t allow investors to make educated investments into private technology companies (which is the best asset class for extraordinary returns).

And I know I’m not the only one who feels this way. Just this August, SEC Commissioner Hester Peirce spoke out about these rules.

And I love what Peirce had to say: “Why shouldn’t mom and pop retail investors be allowed to invest in private offerings? Why should I, as a regulator, decide what other Americans do with their money?”

She went further, saying, “A person’s economic status may demonstrate an ability to withstand losses, but it certainly does not demonstrate financial sophistication.”

She’s absolutely right. It’s not fair…

Fortunately, there have been some positive developments.

The Jobs Act of 2012 made Regulation Crowdfunding deals (Reg CF) and Regulation A or A+ deals possible. But that did little to actually address the problem…

Until late 2020, Reg CF deals were restricted to a $1.07 million raise annually. For an early stage tech company, that isn’t enough money to do anything meaningful. And usually 600–700 investors would hoard the entire $1.07 million investment opportunity.

Plus, the company had to go through some pretty extensive regulatory filings and disclosures that aren’t required by private companies.

This past November, however, the limit was raised to $5 million for Reg CF deals.

Under good management, a $5 million pre-seed or seed round raise can fund a business for a good two or three years. That is enough time for a company to find the right product market fit, develop a go-to-market strategy, and potentially even reach free cash flow breakeven.

Once accomplished, the company then has some great options. It can return to a more traditional VC raise for its next round of funding and do so from a position of strength. Or it can choose to grow more conservatively alone while using its free cash flow to fund the business.

This is a fantastic development for investors and early stage companies. In 2021, I’ll be closely following these developments and looking for great Reg CF deals.

But there’s one more way for everyday investors to essentially gain access to “pre-IPO” shares without ever investing in a private funding round.

I have personally been researching this topic for the last few years. And now my idea is finally ready to bring to my readers…

I’ve cracked the code and found a way for anyone to gain access to the biggest and most disruptive tech companies on the planet… BEFORE they go public.

And you don’t need to be an accredited investor to take part. All you need is your usual brokerage account.

I’ll be sharing all the details with my readers on January 13 at 8 p.m. ET at my Pre-IPO Code Event. I don’t want anyone to miss out, so please mark that date on your calendar. And go right here to reserve your spot.

I hope to see you there.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.