NVIDIA “Acquires” Groq

NVIDIA’s new licensing deal with Groq may not be a formal acquisition, but in terms of antitrust regulations, it...

From coding bootcamps to nanodegrees, there are so many ways we can accelerate the learning process compared to when I was in school…

Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology.

Today, I’ll do my best to answer them.

And if you have a question you’d like answered in next week’s mailbag, be sure you submit it right here.

Let’s begin with a question on using wallets to hold crypto:

I don’t understand why or if I should get a wallet to hold all my crypto as opposed to the wallet it is in when I buy it. Currently, I have some in Bittrex, Coinbase, and Coinbase Pro.

Also, I found the fees in Coinbase higher than in Coinbase Pro. Why should I use Coinbase? I’m very excited to get in on the ground floor, but I see I have a lot to learn. Thank you in advance for your information.

– Renee P.

Hi, Renee, and thanks for sending in your question. The blockchain and crypto space is very new to many investors, so I’m glad you asked the question.

First, it’s perfectly fine to hold your cryptocurrencies in multiple wallets as long as you are comfortable dealing with multiple private keys or passcodes.

There are differences in the kinds of wallets available, however. An exchange wallet is a web-based wallet hosted by an exchange. This means that the exchange is the custodian of your digital assets.

I would encourage investors to only use trusted exchanges with strong security measures. Coinbase is my personal choice for this reason, and it’s why we’re recommending it for my new Unchained Profits research service.

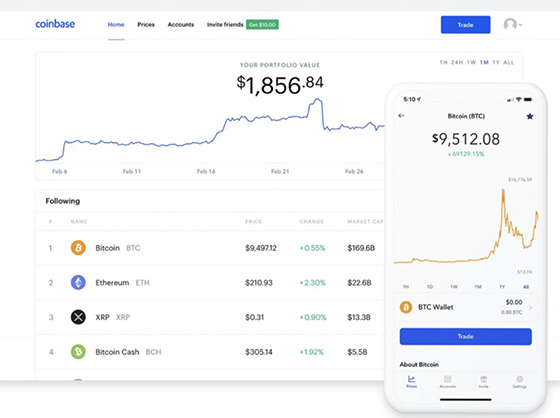

Coinbase is a great entry-level option for buying digital assets, and its security measures have set the standard for the industry. It’s also very user friendly, with an easy-to-use interface.

Coinbase’s User Interface

Source: Coinbase

So if a subscriber wanted to use only one exchange and service – similar to how they use their brokerage platform – Coinbase is most suited for this. It currently supports more than 50 cryptocurrencies, which means it will work well for most investors who are learning about digital assets. And the exchange has ambitious plans to rapidly expand the number of cryptocurrencies available on its platform.

Coinbase also offers simple features that investors may appreciate, such as auto investing. For example, you could set up an automatic weekly purchase of bitcoin (BTC).

If you are a more advanced crypto buyer and understand nuances when placing an order, then Coinbase Pro is another great solution. This is a great exchange platform, and it has lower fees.

Coinbase Pro also offers more advanced features and tools, which means it may appeal to more active traders. The trade-off comes in the form of a more complicated user interface.

Coinbase Pro’s User Interface

Source: Coinbase Pro

The same rule of thumb applies to other exchanges as well. If you are a more advanced user who understands the risks associated with using various exchanges, it’s perfectly fine to find a few that fit your preferences.

I hope this helps you decide, Renee!

Next, a reader wants to know more about cutting-edge genetic editing:

Hi Jeff and friends, you recently wrote in The Bleeding Edge that Deep Genomics turns off cells that are making the wrong proteins. How does it target specific areas of the body and differentiate from cells that work properly? I wouldn’t want to turn off organs entirely!

– Jason A.

Hello, Jason, and thanks for writing in. This is a very natural question and concern when it comes to genetic editing technologies. What you are referring to is off-target editing, and this is something that is widely discussed in the industry.

As we wrote last month, Deep Genomics is developing an artificial intelligence (AI)-enhanced approach to genetic editing. Ultimately, Deep Genomics’ work could one day compete with CRISPR technology.

And its approach is great for diseases that occur when a genetic mutation causes certain cells to produce the wrong proteins. Deep Genomics can correct this simply by “turning off” those cells.

Of course, specificity is key with gene editing since we don’t want any off-target changes. The good news is, Deep Genomics can target specific areas of our DNA for treatment.

This happens through “steric blocking oligonucleotides.” These are short stretches of DNA or RNA that attach to specific places in the patient’s RNA. With genetic editing technologies using RNA, the therapy can be steered to precise locations. To use a loose analogy, it’s like two unique pieces of a puzzle. The therapy is only delivered to the precise location where the RNA matches.

The therapy can then modify the way the cells process the RNA and create proteins. No permanent changes happen to the DNA.

Here’s an illustration of the process:

Source: Deep Genomics

As you can see from the left and right sides of the graphic, the DNA itself hasn’t changed. The genetic editing procedure just affects the protein output. And because of how it’s “coded,” the treatment clearly targets the intended genes.

Off-target editing was a much larger concern five to seven years ago, when genetic editing technology was more of a theory. Today, it has already been proven to cure diseases like beta thalassemia and sickle cell disease, with many others in clinical trials now.

All these genetic editing therapies must go through the normal clinical trial process as defined by the U.S. Food and Drug Administration (FDA). And Phase 1 is specifically designed to determine safety and inform decisions regarding dosing levels for the Phase 2 portion of the trials.

While I don’t expect many problems to be found, any issues with off-target editing will likely be discovered in the laboratory, even before a therapy advances to Phase 1 clinical trials.

What makes genetic editing technology so exciting is that it is the definition of precision medicine. It’s designed to be precise and go straight to its desired target instead of a therapy that affects the entire body like chemotherapy. So we won’t have to worry about turning any organs off when it comes to genetic editing.

Let’s conclude with a question about technology education:

Hey Jeff, I’m a big fan of your research, and I think I’ve read every edition of The Bleeding Edge for over a year now. I’m a college student, so while I don’t have much money to invest right now, I went ahead and became a Brownstone Unlimited member back in February. Hopefully, I can make at least a little money from your research to help me finance my education.

I do have a question for your mailbag. My major is in economics. I really enjoy the subject, but reading your newsletters makes me really excited about all the technological developments that are happening right now. What I’m wondering is what ways can I get involved in the various technological trends you follow in your newsletters? Are there ways that I could direct my career toward working in or with these fields?

Many of your readers probably don’t have the same situation as me, but I’m sure a lot of us would love to get involved in the various projects, trends, and anything else you follow that’s going to change our world! Thank you so much for your hard work!

– Brigham M.

Hi, Brigham. Thanks so much for writing in and for being a lifetime member.

I have to say that I’m jealous. I wish I could go back to school and do it again. I had so much fun, learned a ton, and built some critical skills that have been invaluable to me in life.

And with today’s computing technology, there are so many ways we can accelerate the learning process compared to back when I was in school.

The initiative that you are already taking is fantastic. Just by reading The Bleeding Edge, you are gaining exposure to the most exciting trends and companies in high tech and biotech.

Perhaps you can make a list of the ideas and companies that are the most exciting to you. You might even be able to get a summer internship at one of them.

Have you thought about the kind of work that you’d like to do? Would you like to become an economist? If so, I definitely recommend a Master’s degree at a minimum. Microeconomics – especially as it applies to competitive dynamics, industries, and business – is really interesting.

You also might consider going into sales or business development for a technology company. Not everyone in a tech firm has an engineering or science degree, and there is always a need for talented people who are passionate about tech and technology-literate to help drive the business. I ended up making the jump from an engineering role to the business side in my late 20s, and I never looked back.

There is one thing that I would recommend you do, which is learn how to code. Supplement your economic degree with computer science. Maybe even minor in computer science.

To start, I recommend learning Python, and since you’re in economics, it probably makes sense to learn R as well for statistical analysis. Anyone can learn to code, and these skills will make you more attractive to an employer and will serve you well.

And if you find areas in technology that you are really excited about, you can also pursue nanodegrees. We can think of these as highly specialized certifications for very specific areas of knowledge.

Udacity is one great option for this kind of additional training. Udacity offers nanodegrees in everything from data science to autonomous systems, programming, and cybersecurity.

It even has a nanodegree for blockchain development. These specializations can give you the chance to explore various areas of technology and determine your preferred area of focus.

And if you’re looking for other resources for online learning, I’d recommend you look at edX. A lot of the content is free, and edX is backed by MIT.

Coursera is another site for online learning, and there are several AI/machine learning courses from famous professors at Stanford available.

I hope that helps – and I wish you luck as you continue your education, Brigham!

That’s all we have time for this week. If you have a question for a future mailbag, you can send it to me right here.

Have a great holiday weekend.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

Read the latest insights from the world of high technology.

NVIDIA’s new licensing deal with Groq may not be a formal acquisition, but in terms of antitrust regulations, it...

When Elon Musk launched his newest company, xAI, in January 2024, most didn’t take him seriously…

We’re on the fast track to gigawatt-scale AI factories… and to artificial superintelligence (ASI).