Van’s Note: Van Bryan here, Jeff Brown’s longtime managing editor. Today, we’re sharing our final interview with Jason Bodner.

Over the past two days, we’ve learned Jason’s story working on Wall Street. He’s revealed how his experience executing “big money” trades helped him identify outlier stocks – investments that exponentially outperform the market. Open outlier trades in Jason’s portfolio now show returns of 244%, 391%, and even 743%.

Today, I’m going to ask Jason point blank: How does he do it?

How is it possible for him to consistently pick these winning outlier investments? Since Jason started issuing public recommendations, his win rate stands at 86%. And the average return on open positions is now 94%.

As you’ll see, Jason combines his analytical knowledge with data from a stock-picking “machine” to reliably find winning trades.

And be sure you check out Jeff and Jason’s newest investment presentation. They’re calling it The Outlier Investment Summit. It’s live right now. Go here.

|

Van Bryan: Jason, thanks for taking the time to speak with me these past few days. You’ve told us about your background working on Wall Street, and you also revealed how you found these “outlier stocks.”

Jason Bodner: Of course, it’s been fun.

Van: I reviewed your model portfolio of outlier stocks. Since you started making public recommendations in 2018, your average win rate is 86%. And the average return on open positions is 94%. So, I’ll just ask. How do you do it?

Jason: The truth is, it’s been a long road to get here. As we talked about, I spent two decades on Wall Street. My responsibility was to handle huge trades for clients.

These big money trades were usually tens or hundreds of millions of dollars. Sometimes, I’d even work on trades that were worth $1 billion.

And I learned that all this big money buying could move stocks in a big way. But it’s not enough to just chase the stocks that big money is buying. I also learned you need to buy big money outliers – companies that had great fundamentals like growing sales, earnings, and profits.

Think of outliers like the Tom Bradys, Wayne Gretzkys, or Michael Jordans of stocks. The best of the best.

I found over time that stocks with these two factors – strong and growing balance sheets backed by big money – are the only ones that outperform the market to such a large extent.

And so, I began building this system, a stock-picking “machine” if you will, that could find these outlier stocks for me.

Van: And how does the system work?

Jason: I’ve been steadily developing it for two decades now. Like I said before, it all started as just a tool for me: an algorithm to help me screen stocks for my clients.

But once I realized that big money buying would consistently push stocks higher, I refined the system further. I wanted to see if I could pick up signs of when these “whales” were starting to buy.

You see, big professional investors won’t come right out and tell the world that they are investing in a stock until they have to. By that, I mean until they’re legally required to.

Until then, they try to keep it as quiet as possible. But they do leave clues. I think of them as “ripples.”

These ripples are virtually impossible to spot for most investors. I just happened to spend more than a decade on the front lines. So I knew what to look for.

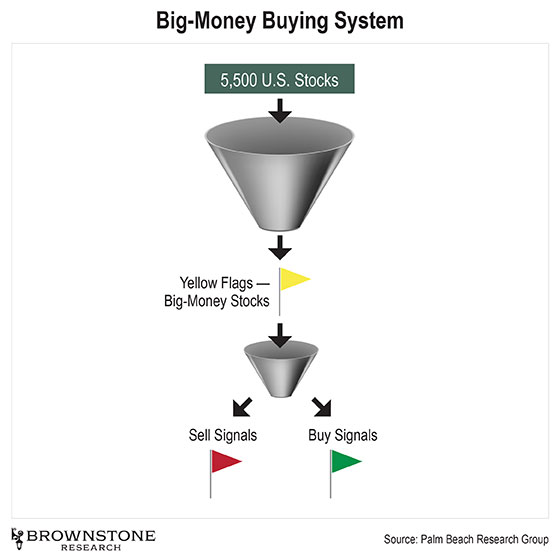

I won’t get into the weeds here, but my system “looks” for a lot of different things to spot these ripples. It looks to see if a stock price gaps higher. It scans for above-average volume and volatility. And it spots any price breaks that are higher than recent ranges. All of these are signs that big money is getting into a stock.

And when I first started testing this system, what I found really surprised me…

Of the nearly 5,500 U.S. stocks that I follow, I only got big money signals on about 1.5% of them. We’re talking about a tiny fraction.

Regular investors massively outnumber professional investors. So it kind of makes sense that 98.5% of the daily trading is ordinary.

And the system wouldn’t just tell me if big money was moving into stocks. It also signaled when it was getting out as well. Both these buy and sell signals began to form a basis for the machine’s process.

Van: Last time you told us that large order flow wasn’t the only quality of an outlier stock. You said fundamentals still matter.

Jason: That’s right. And like I said, I saw this firsthand.

Last time we spoke, I told the story of how I bought so much stock for one client that it soared almost 70% in a month.

But guess what? That company had awful fundamentals…

After that stock shot up from my buying, it went on to fall about 90% in a year or so. So, I knew then that fundamentals absolutely matter. And it’s why I made that a critical part of this stock-picking machine.

Again, my time on Wall Street helped me do this. I was in the right place at the right time. I had this huge rolodex of investing experts. Not to let an opportunity go to waste, I spent years picking their brains. I wanted to know what qualities they looked for in a stock investment.

One guy said he liked to see debt levels below a certain level. Another wanted to see revenue growing at a certain pace. Another watched volatility. Another liked profit margins above a certain percentage.

I went on like this for maybe two years, just gathering information from the people who moved this money all day long. Eventually, I aggregated a huge laundry list of qualities that Wall Street’s top investors use to find their winning stocks.

From there, I started coding an algorithm to rank all stocks in terms of those qualities. The best ones rose to the top. And when big money was buying the best stocks, that’s where the magic happened.

In short, I basically gathered the collective wisdom of myself, my colleagues, and clients. Then I distilled it down into one clean system: my outlier stock-picking machine.

Van: You make it sound so easy…

Jason: (laughs) I think Morgan Freeman said, “The trick to any profession is making it look easy…”

Well, I can tell you it definitely was not easy. My team and I spent decades refining this system. It’s automated now, so we just wake up and evaluate the results daily.

And here’s an important point to understand: this machine provides me with a short list of potential outlier stocks. They have all the best qualities we want to see in an investment. But to take it even further, I still do my due diligence and analyze this short list to find the best ones.

This stock-picking machine is just part of the equation… The other side of the equation is good old-fashioned analysis.

And not to get too off topic, but I would just say that investing – in general – is not easy.

But these days, we’re told it is. The messaging from apps like Robinhood tells us it is. Young investors on social media tell us it is. You see it everywhere today… easy money.

There’s this memorable eTrade commercial. A truck driver starts investing in stocks. He easily makes so much money that he buys a private island.

Don’t get me wrong. I have nothing but respect for truck drivers. But I know odds. And the odds say that’s not going to happen. Investing is just not that easy.

And there is research to back this up. In 2017, a researcher named Hendrik Bessembinder wrote a study titled “Do Stocks Outperform Treasury Bills?”

He studied 26,000 stocks over 100 years’ time. And he found that only 4% of all stocks account for 100% of the gains of stocks over Treasury bills.

Put more simply, if you can’t find these 4% of stocks, then you would have just been better off parking your money into Treasurys. I’ll tell you, finding the top 4% of anything, anywhere, isn’t easy.

Van: And your machine finds this 4% – these outliers?

Jason: I think our track record proves it does. Our open outlier trades are showing average returns of 95%. And we’ve enjoyed a win rate of 86% since 2018.

And among those, we’ve had some incredible standouts. Think of them as outliers in a portfolio of outliers.

The Trade Desk: up 743%.

Veeva Systems: up 127.8%.

NVIDIA (NVDA): up 191.3%.

Paycom Software (PAYC): up 244.4%.

SolarEdge Technologies (SEDG): up 391.2%.

I don’t say this to brag. I’m just trying to show how confident I am in this method of investing.

Because investing not only isn’t easy, but the odds are against you winning. There’s a 96% chance you won’t even beat Treasurys. But I’m telling you that you can win. To borrow a phrase from Jeff, it’s possible to “tip the odds in your favor.”

And that’s what I’ve done here. This system’s purpose is to find the 4% that outperform like no other.

Van: I agree, Jason. So I have to know, what is your system flashing buy signals for now?

Jason: I recently filmed an investing presentation with Jeff where I share the names of five outlier stocks that my system just delivered to me. Each of them has the potential to be a great outlier stock.

[Van’s Note: For readers who would like to see the names of the stocks Jason’s system is signaling now, please go right here.]

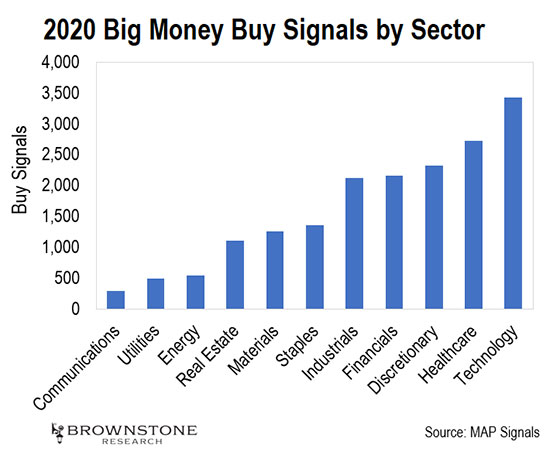

But here’s what I will say right now. My machine doesn’t just flash buy signals on individual stocks. It monitors entire sectors. It tells me which sectors the big money is buying.

And Jeff will be happy to know that the sector that the big money has bought up recently is technology. I know Jeff regularly tells his readers that the best investments are in cutting-edge tech. I agree with him. And my system does too.

Van: That’s great, Jason. Thanks for sharing. Before we conclude, I believe you have a big announcement you’d like to share with the readers.

Jason: That’s right! A little while ago, Jeff Brown approached me and asked if I would be willing to join the team at Brownstone Research. And I’m happy to report that I accepted.

I’ll be publishing all of my research and all of my recommendations with my research service, Outlier Investor. And we’ll be publishing it all under the Brownstone Research banner.

So, I hope readers have enjoyed the ideas and the research. They’ll be hearing more from me.

Van: Congratulations, Jason. We’re thrilled to have you.

Jason: Thanks very much. I’m looking forward to everything that comes next. And most importantly, I can’t wait to find our next outlier stocks.

Van’s Note: : You heard it here. Jason Bodner is the newest editor with Brownstone Research. And his research product – Outlier Investor – is now live.

As readers know, Jeff Brown has high standards for providing quality research. And Jason is the first editor Jeff has asked to join since Brownstone Research was launched last year.

And if you’d like to gain access to Jason and all of his research, then I strongly encourage you to go right here.

On behalf of Jeff, Jason, and the entire team, we thank you for being a reader. And we hope you continue to enjoy your subscription with Brownstone Research.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.