As 2021 ends, it’s time to look ahead at 2022. What’s in store for us – and more specifically – for stocks?

Today, I’d like to share some predictions for the coming year… and ways we can succeed as investors.

2021 was another year like no other. We went from lockdowns to a reopened economy. We went from pandemic fear to plentiful vaccines. We grew used to a virtual working world.

And this was all reflected in stocks, too.

Now we’re beginning to see a sudden shift in attitudes. Popular “stay-at-home” stocks that made life bearable and enabled us to function are suddenly out of favor. Videoconferencing, digital signature, and cloud-based companies launched into the stratosphere during the pandemic… And now they’re falling back to earth.

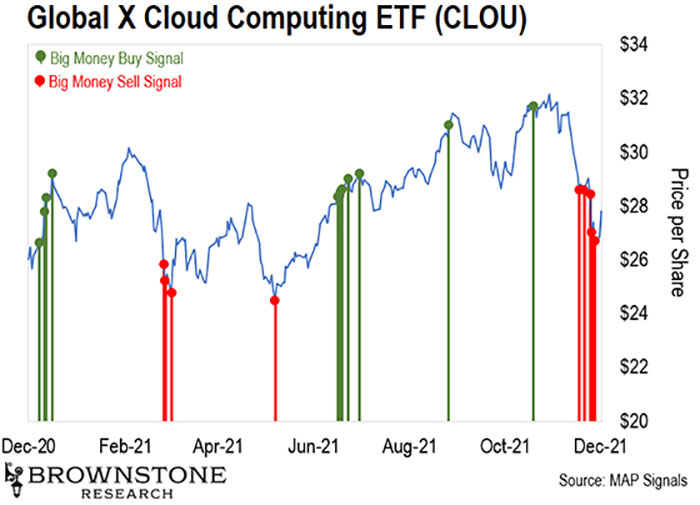

But that’s giving us a great opportunity in our first 2022 topic: cloud computing…

Many companies are declaring that buying patterns of their customers are returning to normal. This means they think the pandemic bump is over, and things are going back to normal.

That may be true in the immediate term, but I believe the future is forever changed. Fewer and fewer contracts will be signed by pen. More and more people will use e-signing instead. Meetings will forever have video as an option going forward.

We will exercise using the cloud, watch TV on the cloud, and in effect, do almost everything on the cloud.

As a result, I predict cloud storage and specialist companies will continue to grow in importance over the coming year.

One simple way to play this is to invest in the cloud-focused Global X Cloud Computing ETF (CLOU), which pulled back substantially at the beginning of December:

Any pullbacks like this will provide a great opportunity to buy at a discount.

And cloud computing won’t be the only trend we’ll see in 2022…

As of this writing, we’re facing a few market headwinds…

First up is Omicron (and any future COVID-19 variants that pop up going forward). People want to be out and about… But suddenly, the new variant renewed some people’s fears.

But I believe these kinds of scares will turn out to be nothing big.

The Telegraph reported:

The first South African doctor [Dr. Angelique Coetzee] to alert the authorities about patients with the omicron variant has told The Telegraph that the symptoms of the new variant are unusual but mild…

They included young people of different backgrounds and ethnicities with intense fatigue and a six-year-old child with a very high pulse rate, she said. None suffered from a loss of taste or smell.

“Their symptoms were so different and so mild from those I had treated before,” said Dr. Coetzee…

There are some encouraging takeaways, such as that a significant portion of those who presented with symptoms of the new variant were unvaccinated and that her six-year-old patient “was so much better” within days. So far, symptoms appear mild. Patients mostly report fatigue, fever, and headache. Many patients recover within two or three days.

As of yet, we have not had reports of serious health issues related to Omicron… only quick-to-react governments stoking global fear.

So for 2022, I personally do not see Omicron (or any similar variants) as being a further threat to our health or the stock market.

But virus fears aren’t the only ones we’re seeing right now…

Inflation worries have investors spooked. The Fed is talking about curtailing purchases and lightening up on quantitative easing. That stokes fears of rising rates.

But despite that talk, the 10-year Treasury yield still says it’s a great time to buy stocks. At writing, it’s currently fluctuating around 1.36%.

And while S&P 500 dividends are taxed at a max rate of 23.8%, Treasuries max out at 40.8%. This means investors would have 24% more money in their pockets by owning stocks over bonds:

| INVESTMENT | $ INVESTED | YIELD | MAX TAX RATE | BEFORE TAX RATE | TAX OWED | AFTER TAX RETURN | |||||

| 10-YEAR TREASURY (YIELD) | $ 100 | 1.360% | 40.8% | $ 1.36 | $ 0.55 | $ 0.81 | |||||

| S&p 500 (DIVIDEND YIELD) | $ 100 | 1.360% | 23.8% | $ 1.31 | $ 0.31 | $ 1.00 | |||||

| Source: Multipl, FactSet | |||||||||||

| OWNING STOCKS ADVANTAGE OVER BONDS: | 24% | ||||||||||

We also saw huge selling in stocks at the beginning of December.

According to my data, it was the most selling since the March 2020 pandemic crash.

The dip in the SPDR S&P 500 ETF Trust (SPY) didn’t look that dramatic, but the downtrend in the iShares Russell 2000 ETF (IWM) was much sharper:

The movement also tracked closely with my Big Money Index (BMI). The BMI (light blue line) tracks institutional money flows going in and out of stocks.

The BMI fell quickly. In fact, the BMI easily could go oversold if we don’t see more buy signals break up the trend.

If we do go oversold into the new year, two things will likely happen:

We’ll feel a lot of despair and pain.

It’ll be a historically phenomenal time to buy stocks. That will be the time to strap on the helmet and get in there to buy great stocks that are getting pummeled.

And overall, it’s important to ask ourselves: Are we headed into another global lockdown and economic freeze?

I personally don’t think so. The Omicron variant doesn’t appear to be more deadly than the original strain of COVID-19. In fact, as viruses mutate, they usually become more infectious but less dangerous.

Should we see lower market prices, stock dividend yields will grow… while Treasury yields will likely fall as investors flee to the safety of bonds. That too is a screaming buy signal for stocks.

Also noteworthy, FactSet estimates S&P 500 earnings growth for Q4 2021 is 20.9%. That would be the fourth straight quarter above 20%.

Yet while those numbers are strong, there are some clouds on the horizon…

Fewer companies are issuing positive earnings-per-share (EPS) guidance for Q4.

Analysts aren’t raising quarterly EPS estimates for the first time since Q2 2020.

As I shared above, I believe these fears about growth slowing are a result of investor sentiment about inflation, the potential Fed tightening, and COVID-19 variants.

The injustice here is that great stocks are getting punished with overall selling. Yet the headlines give an overheated market an excuse to sell-off.

But I don’t believe all this “bad news.”

In fact, I think strong company earnings and low rates will keep stocks a favorable investment going into 2022. Any temporary pain will present a rare buying opportunity. That’s when we should shop for fundamentally superior stocks showing weak technicals.

That’s where the deals come along: when the Michael Jordan’s of stocks go on sale.

That brings me to my last prediction: Outliers will continue to lead all other stocks.

Outlier stocks are the 4% of stocks that accounted for 100% of the market gains above Treasuries since the 1920s. I have spent my life devoted to finding, analyzing, and investing in outlier stocks.

They can be volatile – sometimes moving up and down even more than the market itself – but over time, there is nothing like the profile of an outlier stock.

You know the type I am talking about: the Google’s, Amazon’s, Apple’s, and Microsoft’s of the world. They too were once small growth companies finding their way.

And in 2022, I predict there will be some compelling outlier opportunities found in dividend growth and high-quality, profitable small-cap growth stocks… That’s my vision for 2022.

I’m excited to see what happens in the coming year, especially in outlier stocks.

Happy New Year, everyone!

Jason Bodner

Editor, Outlier Investor

P.S. There’s a lot to look forward to this year, and I can’t wait to get started.

Every day in the wee hours of the morning, the software I created finds the top stocks that should be on our radar… And lately, it’s spotted four tech stocks that should be on every investor’s radar.

If you’d like to start the new year off right by investing in outlier stocks, then please, go right here to learn more about how to join me as we hunt for the top 4% of stocks.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.