Dear Reader,

The semiconductor shortage continues to grab headlines as the world sees ongoing product shortages due to the absence of key semiconductors.

The headlines tend to be generic, as if all semiconductors are alike. But Bleeding Edge readers know that they aren’t.

The semiconductor industry has managed to meet most demand for the leading edge – most advanced – semiconductors that are used in the highest-volume consumer products such as smartphones.

Where the industry has struggled to meet demand is in more mature semiconductors that have been used for years. These are the kinds of semiconductors that are typically used in cars, household appliances, and other electronics that aren’t particularly sensitive to size and power consumption.

Most have said that this is a supply chain problem, or that there is a lack of investment from semiconductor companies. That’s not the case. The industry continues to invest over $100 billion a year in new manufacturing capacity.

What changed was the spike in demand. The economy was incredibly strong going into the pandemic, and consumption actually accelerated as a result of it.

This increased demand for semiconductors of all kinds. And because the more mature manufacturing processes weren’t used to these kinds of spikes, we ended up with quite the shortage.

We’ll start to see some of the pressure lift in the second half of this year, but shortages in certain areas will persist into 2023.

To get an even better understanding of what is happening in the industry, we have to look farther out. And in order to do that, we need to dig even deeper into the semiconductor supply chain.

Today, we’re going to have a look at silicon wafers. This is the material from which semiconductors are made.

Polycrystalline Silicon Ingots and Silicon Wafers

Source: Sumco

Silica rocks are reduced to silicon metal in a special furnace from which polycrystalline silicon ingots are produced. These ingots are manufactured at an almost unbelievable level of purity around 99.999999999%.

From this material, wafers of standard industry sizes – the largest of which are typically 300 millimeters (mm) – are sliced at a thickness of about 1 mm. It is upon these wafers that semiconductor designs are etched using special equipment.

After the semiconductors have been “drawn” into the wafers, they are treated, cut up into individual semiconductors, and packaged for use in electronics.

Without these wafers, there would be no semiconductors, which is why I pay attention to what is happening in that part of the industry. This is a highly specialized market, and one that requires unbelievable levels of quality.

So, it’s no surprise that Japan dominates over 50% of the global market for wafers. Here is what the market looks like on a global level:

|

Shin-etsu (Japan) |

29.4% |

|

Sumco (Japan) |

21.9% |

|

GlobalWafers (Taiwan) |

15.2% |

|

Siltronic (Germany) |

11.5% |

|

SK Siltron (S. Korea) |

11.4% |

|

Soitec (France) |

5.5% |

The reality is that without Japan’s two suppliers, the entire industry would fall over. That’s why it’s useful to track their own forecasts for the industry. And this is where things get interesting…

On Sumco’s latest quarterly earnings call, the company noted that it has already booked orders for its entire production of 300 mm wafers through 2026. That’s five years of production already accounted for, and that includes the new production capacity that Sumco is bringing online.

The 300 mm wafers are the ones that are in the highest demand for the highest-volume semiconductors. Taiwan Semiconductor Manufacturing (TSMC) uses these to support the semiconductor manufacturing for companies like NVIDIA, Qualcomm, Apple, and Advanced Micro Devices (AMD).

It’s the 150 mm and the 200 mm wafers that are typically used for the kinds of applications that I mentioned above – automotive, consumer electronics, and also industrial applications. This is where we are seeing the worst shortages.

Sumco isn’t even taking long-term orders right now for these products, as there is so much demand. Prices rose 10% in 2021, and they’re expected to increase every year for years to come. Sumco stated that the demand for these smaller wafers will far exceed the manufacturing capacity for many years to come.

We are entering the golden age of semiconductor production. In conjunction with software, these tiny devices are being used for almost every application thinkable. Due to the scale of production and automated manufacturing processes, the costs have dropped to the point where it makes sense to use them everywhere.

Combined with underlying economic growth, we have the demand/supply imbalance that we are seeing today and will see for years into the future.

I’ve never seen the semiconductor market as vibrant as it is today. There is so much opportunity and innovation that we’ll need to stay on top of here in The Bleeding Edge.

And before we turn to our next topic, I’d just like to remind all readers about an important event happening on March 16 at 8 p.m. ET. On that date, I’ll be unveiling what could be the most important breakthrough of my career.

For the past five years, I’ve been quietly working on a secret project. And after half a million dollars committed to research and development, I’m finally ready to unveil my discovery.

What my team and I have created is a machine that leverages bleeding edge technology already in use at companies like Tesla, Google, and Amazon.

And we will be using it to spot patterns in the crypto market that no human – or even a team of humans – can identify. This project is so important that I even filed a patent to protect my intellectual property.

I call it simply…The Perceptron.

And I would love it if all Bleeding Edge readers could join me for its unveiling. To reserve your spot, simply go right here.

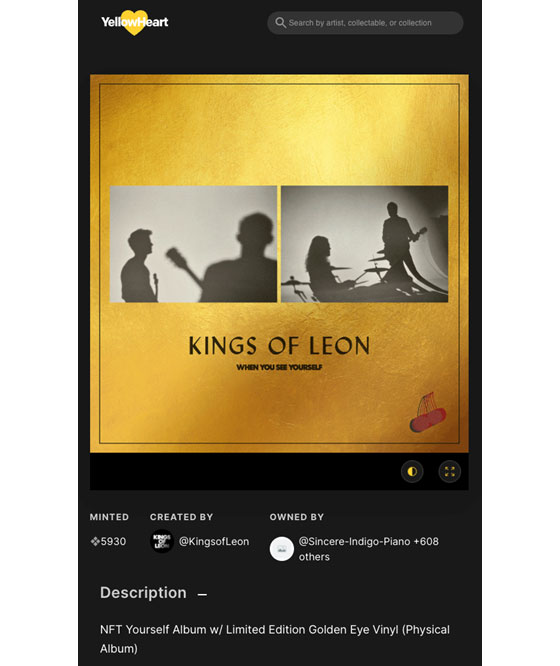

The band Kings of Leon just became the first to release an album as a non-fungible token (NFT). While all Bleeding Edge readers may not recognize the name, it’s a great band, and I was excited to see this announcement.

I’m a fan. My favorite album is Walls. And this is a great case study in how NFTs can empower artists and their fans.

The new Kings of Leon album is titled When You See Yourself. The NFT version of the album is available on the YellowHeart NFT marketplace. Consumers can also purchase the album on all of the normal platforms – Spotify, iTunes, Apple Music, Amazon, etc.

So we may ask… Why would consumers want to purchase the NFT version of an album from a platform that most people aren’t familiar with?

The answer is that the NFT comes with additional perks attached. This is what makes NFTs so interesting.

Kings of Leon’s NFT Album

Source: Yellowheart

To start with, those who purchase the NFT will immediately be able to download the music to their computer or smartphone. And Kings of Leon will also send NFT-holders a limited edition vinyl record of the album as an extra benefit.

This is what I refer to as a “digi-fizzy.” The term refers to digital products that come with physical products attached.

And Kings of Leon didn’t stop there…

For the big spenders, the band also created six “golden ticket” NFTs that will go up for auction. Consumers who bought the NFT album will have the opportunity to bid on these six golden tickets as well. Bidding will start at $95 and can go up to $2,500 maximum.

And get this – the tickets will entitle the holder to four front-row seats at any Kings of Leon show, anywhere in the world, once per tour. How’s that for a perk?

What’s more, the band will arrange for a luxury SUV to provide transportation to and from the show. The SUV will pull up at the venue right next to the tour bus. That’s where a concierge team will meet golden ticket-holders and escort them inside to a private meet and greet with the band.

And remember – this will happen once per tour. Golden ticket-holders can treat three friends to this V.I.P. experience over and over again. This gives them an incredible opportunity to develop a relationship with the band members.

Talk about a unique value proposition. Also interesting is that these NFTs can be sold. Once a fan has enjoyed the perks of a golden ticket, they might choose to sell to another fan, most likely at a much higher price.

I know non-fungible tokens are still a new topic for many investors. And when many of us think of NFTs, we picture funny pieces of art or collectibles. It can sometimes feel like a bit of a crazy asset class.

But what this development shows us is that NFT technology goes far beyond just Bored Apes or the famous CryptoPunks. NFTs have the potential to disrupt several industries and democratize access to assets that were previously off limits to normal investors. As I’ve said before, this asset class is not going anywhere but up.

As a result, it’s worth mentioning that there are already some very exciting investment opportunities in the NFT space. I recently unveiled three NFT investment recommendations to readers of my blockchain research service Unchained Profits.

To learn more about the NFT investments I’m recommending now, go right here

Starting March 24, the first-ever fashion week begins in a metaverse. It will be a four-day event. And it’s all going down in Decentraland – a popular metaverse we have been tracking in these pages.

This is just more proof that metaverses and NFTs are going mainstream. I’ll explain with a little context…

In the legacy fashion world, New York Fashion Week is a massive event. Annually, over 230,000 people show up to see the latest fashion designs.

And the event is a boon for the local economy. New York Fashion Week facilitates $900 million in economic activity every year.

So what we are seeing here is the Web 3.0 analog. Instead of New York City, we are going to have fashion week in the Decentraland metaverse.

Still, it comes with all the traditional fanfare. Those who attend the Decentraland fashion week can attend live concerts at branded after-parties, visit showrooms, shop at pop-up stores, and even watch the runway from a front-row seat.

Decentraland’s Fashion Week Environments

Source: Vogue Business

Digital models will walk the runway showing off some unique fashion designs. And each piece will be in the form of an NFT.

What’s more, some of these NFTs will be available for sale. This will allow users to outfit their own metaverse avatars with the latest fashion trends. And some of these collections will even be sold as a “digi-fizzy.” Buyers will get the digital wearable as well as its physical counterpart.

So this opens the door to a new form of status within a metaverse. Users can dress their avatars in the latest trends from fashion week… for the right price.

And I should point out that the fashion trends on display will be the real deal. They come from a who’s who of luxury brands, each of whom will attend the digital event. This includes brands like Paco Rabanne, Gucci, and Dolce & Gabbana (D&G).

Of course, that prompts the question… Why would these iconic brands be interested in a metaverse-based fashion week?

We might be surprised to learn that the high fashion industry has been very quick to adopting this technology. In fact, D&G has already made over $6 million selling NFTs.

And recently, Morgan Stanley put out research that envisions the luxury NFT market hitting €50 billion by 2030. That’s how big of an opportunity these brands are facing with this trend.

And it makes perfect sense. The fashion world thrives on one thing: status-signaling. Having the latest Chanel handbag or Gucci loafers signals – in certain circles – status. These brands are taking this formula and applying it to digital worlds.

Once again, this just shows that metaverses are more than video games for kids. They are unique digital worlds with their own economic incentives. And for some businesses, they are a new stream of revenue.

I’ll continue to share the best investments in the metaverse space as they develop. For more information on this burgeoning trend, go right here.

It seems Diem just won’t die.

As a reminder, Diem was Facebook’s (now Meta’s) ambitious stablecoin project. At first, it looked like Facebook wanted Diem to be a global reserve currency, backed by a basket of national fiat currencies.

But that plan received a lot of regulatory pushback from central banks and governments around the world. This caused Facebook to ponder making Diem a U.S. dollar-backed stablecoin.

But last month, the company capitulated and sold Diem to Silvergate Capital. That appeared to be the end of Diem.

However, several of the key software engineers behind Diem just formed a new company called Aptos. The rumor is that they are in the process of raising $200 million to basically bring Diem back to life. I’m even hearing that Andreessen Horowitz may back the new company.

We don’t see things like this happen very often. Intellectual property (IP) rights usually prevent former employees from rekindling an old project once the assets have been sold off.

But there’s a nuance here. Much of Diem’s code was open-source. That means it’s readily available online. Anyone can view the code, copy it, and build on top of it.

That’s what the team at Aptos plans to do. They are taking the open-source portion of the Diem code. Then they will add their own touches to create a brand new stablecoin.

And the pitch for the project is straightforward. It’s Diem without all the baggage that comes with being attached to Facebook.

In the team’s own words:

Since departing Meta (formerly Facebook) we have been able to put our ideas into motion, ditch bureaucratic red tape, and build an entirely new network from the ground up that brings [our ideas] to fruition.

If the Aptos team does in fact raise $200 million out of the gate, they will have incredible resources to advance this project very quickly. That makes this one of the most interesting blockchain projects to follow in 2022.

We’ll certainly be tracking Aptos closely going forward.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. And I look forward to seeing all my readers on March 16 for my investing summit, Project Perceptron. As I mentioned above, I’ll be unveiling a secret project that has been years in the making. Find all the details right here.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.