Last week, we had an interesting look at how dramatically the new “positive” cases of COVID-19 have been collapsing. We were able to get a clear view on the key drivers behind such a dramatic drop in the numbers since early January.

With the rapid shift toward antigen tests – and the newly approved T-detect test capable of determining cellular immunity – we’ll finally be able to get a far more accurate set of data with regards to new COVID-19 cases (those that are actually infected and infectious).

And we’ll also get a feel for what percent of the population has already been infected with COVID-19 and developed cellular immunity.

Aside from that, there is one more data point to put things in full context – hospitalizations. After all, since we haven’t been able to trust the “positive” COVID-19 case data, hospitalizations tend to be more reliable.

The easiest way to understand what is happening right now is through a simple graphic.

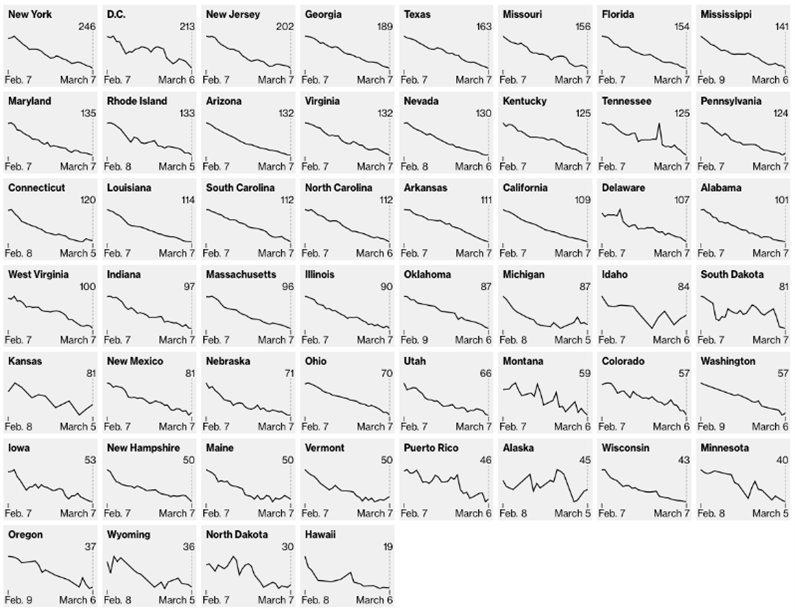

Hospitalizations Per Capita Due to COVID-19

Source: Bloomberg

The images above show the last 28 days of hospitalization per capita due to COVID-19 on a state-by-state level. They represent all 50 U.S. states, plus the District of Columbia and Puerto Rico. Striking, isn’t it?

The trend is down in all images. And we can see a very strong, consistent decline in most.

Better yet, this has been the case since early January of this year. We can see this clearly in the chart below, which maps COVID-19 hospitalizations. The chart shows a peak in hospitalizations during the week ending January 9.

The immediate decline following the week after January 9 is remarkable. And while we might be inclined to think that this data is sound, there are two critical things for us to consider.

First, PCR tests were widely used to determine if a patient was infected with COVID-19 or otherwise in 2020.

Here’s a perfect example… Someone enters the hospital with chest pains from a heart attack and ends up getting tested for COVID-19. The patient gets a false positive on a PCR test, so this patient is classified as a COVID-19 hospitalization.

The second distortion is that a hospital can receive a $20,000 bonus for every confirmed or presumed COVID-19-infected patient. This is the case even if the patient is discharged within a single day.

With the decline in daily testing, the shift to antigen tests, and increasing immunity to the virus, we are seeing a sudden end to this fear- and panic-induced nightmare.

And on a national level, inpatient beds are only at 73% capacity and ICU beds are at just 70.95% capacity. And by my projections, within a few weeks’ time, the COVID-19-related hospitalizations per capita will drop to the same levels that we saw back in March of last year.

Spring has arrived.

Now let’s turn to today’s insights…

China’s plans for its central bank digital currency (CBDC) have just kicked into high gear. The government has now expanded the scope of its consumer trials from Shenzhen to Shanghai, Beijing, and other large cities. This is a sign that China is getting closer to a nationwide rollout of its CBDC.

As a reminder, China is calling its digital currency DCEP, which stands for digital currency electronic payment. It began testing the currency internally in 2019 with large national banks and Chinese mega-corporations like Alibaba and Baidu.

Then it began public testing last year by distributing 10 million DCEPs to 50,000 citizens in Shenzhen last October.

To access their DCEPs, these citizens simply downloaded a digital wallet on their smartphones from a state-run application. They were then able to spend the money by using unique QR codes from their digital wallets. A store simply scans the individual’s QR code for payment.

Even those who aren’t familiar with QR codes by name have almost certainly seem them before. They are very simple to use and look like this:

A QR Code

Source: World Bar Codes

To be clear, this is a race. CBDCs could reshape the global financial system. And those countries with the greatest CBDC adoption stand to gain immense geopolitical power.

And now that it is testing DCEPs in its major cities, including the capital of Beijing, China is clearly leading all other global powers in that race.

We shouldn’t forget that the 2022 Olympics will be hosted by China. It makes perfect sense for China to announce a nationwide deployment ahead of the Olympics. Doing so would accelerate national adoption, and China could even authorize foreign visitors to use DCEPs during their stay. That would lead to China’s CBDC gaining international attention as well.

Is this a play to supplant the U.S. dollar as the world’s reserve currency? Wouldn’t it be incredible if we never had to physically change paper bills from one currency to another when we travel internationally?

We have the technology to change currency from one central bank digital currency to another today. What’s exciting to consider is that digital currency will become mainstream over this decade… and hopefully within the next few years.

So China is moving forward at full speed with the DCEP. And that’s going to light a fire under other countries (including the U.S.) to accelerate development of their own CBDCs. I expect we’ll see some announcements around this topic later this year.

And if you want to see my top play for the coming changes to our financial system, you can go right here to watch my recent presentation.

We had a look at Instacart back in November. This private company has been on an absolute tear, and it just had another massive venture capital (VC) round.

To bring newer readers up to speed, Instacart is a home delivery business primarily used for groceries. The company provides a platform that links consumers with grocery stores and other popular businesses. Then it facilitates online orders and handles the delivery.

If we go back to December 2018, Instacart was valued at $7.8 billion after its Series F funding round. But not much happened with the company in 2019. And it started to fall off the radar.

Then the COVID-19 pandemic hit.

Demand for Instacart’s services exploded with the pandemic, and the company rushed to hire 300,000 new employees in an effort to keep up. This required Instacart to complete several more funding rounds to support its growth.

Instacart raised $325 million in a Series G round in July of last year. That valued the company at $13.8 billion – nearly double where it was before the pandemic.

Then Instacart raised another $200 million in its Series H round last October. That put the company’s valuation at $17.7 billion.

And last week, Instacart raised $265 million in another late-stage VC round. The company is now valued at $39 billion. That means it is five times more valuable today than it was prior to COVID-19. Talk about being in the right industry at the right time.

Instacart is now one of the most valuable private companies in history. And there’s no doubt that it is gearing up for an initial public offering (IPO). This will likely be its last VC round. That’s why I will be tracking Instacart closely in the coming months.

Now that people have experienced the convenience of home grocery delivery, I am confident that this trend will continue even after COVID-19 is a distant memory. Enhanced demand was initially in response to fear. Continued demand will be in response to convenience.

And get this…

Last year, e-commerce grocery sales were just 10% of the total U.S. grocery sales. The market is projected to grow to 21.5% of all U.S. grocery sales by 2025. In other words, this market is wide open. We’re still in the rapid-growth stages of an emerging industry.

And Instacart has already become a profitable company. That wasn’t the case prior to the pandemic.

Pair that with the fact that the IPO market is on fire right now, and we have the recipe for a very successful public offering. That makes this company one to watch.

We will wrap up today with an interesting yet disappointing announcement from Microsoft.

Microsoft just revealed its new Mesh platform. The company is presenting it as a bold vision for the future of augmented reality (AR) and virtual reality (VR) applied to team collaboration. We can think of it like Zoom on steroids.

The technology comes from Microsoft’s acquisition of an early stage company called Altspace VR. Altspace created a virtual world in which people used avatars to walk around and interact with each other.

The company envisioned a platform where people could get together virtually to experience live concerts, attend comedy shows, play games, and just hang out with each other. And it would all be done through their avatars from the comfort of their own homes.

It is clear to me that this vision was correct. That’s where the world is going.

But Altspace VR was too early. It ran out of cash by 2017, which is when Microsoft swooped in and bought it outright. The sum was never disclosed, but there’s no doubt that Microsoft got the company on the cheap.

With the Mesh platform, Microsoft has taken what Altspace VR developed and applied it to its own HoloLens VR headset. The idea is that people will wear the bulky HoloLens headset to do their video calls in a 3D space that enables collaboration. Here’s a snippet of the Mesh presentation:

Microsoft Mesh

Source: The Verge

I look at this and have to ask – Do we really think the future of business meetings and conferences will look like this? To me, this is nothing more than Microsoft Teams in a cartoon environment.

I agree that the future of collaboration will be in virtual 3D environments. But it won’t look like this. And it certainly won’t require us to wear a big, bulky, and expensive headset all day.

So the vision is right. But Microsoft’s technological implementation is completely off. My suspicion is that Microsoft is simply trying to create a market for the HoloLens here.

So what is the answer?

As regular readers know, I am a proponent of a technology called holographic telepresence. This tech allows us to “beam” ourselves into a virtual environment to interact with people in real time. The difference is our avatars look exactly like we do, right down to the facial expressions and body language.

That’s the future of collaboration.

Several companies are currently working on holographic telepresence right now. Somebody is going to crack the code at some point and explode onto the scene.

When that happens, it will rip market share from everybody operating in the collaboration space – especially Microsoft Teams and Zoom.

That’s what I’m excited about. Microsoft’s Mesh platform is nothing but a sideshow.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. Instacart isn’t the only early stage company making waves right now.

In my 2021 prediction series, I said that we will see record levels of capital raised from IPOs in 2021. And so far, that prediction is ringing true.

Through March 8 of last year, 35 companies had gone public, raising nearly $10 billion in the process. Not bad at all.

But so far this year, 288 companies have already gone public. And these IPOs have raised nearly $89 billion. There is a staggering amount of money flowing into early stage companies right now. And that is completely reshaping the tech investment landscape.

The problem is, most of these IPOs are incredibly overpriced by the investment banks. Investors buying in at the excessive valuations are all but guaranteed to lose money.

However, there is a small subset of tech companies that are overlooked. That’s because they go public much earlier in their life cycles than the high-flying tech companies like Uber, Slack, and Palantir.

I’ve been studying this small subset of the tech sector for years now. I’ve found that, thanks to a government agency, these stocks have a “timer” attached to their share prices. And once this timer hits zero, these stocks can explode hundreds of percent in days or even hours.

That may sound too incredible to believe, but I’ve used strategic investments in these “timed stocks” to generate investment gains of nearly 200% on average in about eight months for subscribers. We’re talking about nearly tripling our money in a short period of time.

In fact, our timed stock investments were so successful that I had to stop talking about them for nearly a year because demand was so high. These stocks are simply too small for me to recommend to a larger audience.

Thanks to the IPO boom that we’re seeing right now, though, I am finally able to talk about timed stocks publicly again. My pipeline is far more robust now than it has ever been.

And that’s why I’m hosting an investment summit on this topic next week. We’re calling it Timed Stocks: Final Countdown. And it will happen on Thursday, March 18, at 8 p.m. ET.

What are timed stocks? And how are we able to potentially generate triple-digit returns on them so quickly? Please tune in to find out. I’ll answer these questions and more next week.

As always, the event will be free to readers of The Bleeding Edge. Just go right here to reserve your spot.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.