8.5%…

That’s the most recent inflation reading as measured by the Consumer Price Index (CPI). Put another way, our money is now worth 8.5% less than it was 12 months ago.

Even if we exclude the notoriously volatile “food” and “energy” categories, inflation is now measuring in at 6.5%. And the sad truth is that the real inflation figures are likely much higher.

For instance, the CPI tells us that the cost of “shelter” has increased by 5% year-over-year. That doesn’t sound terrible. But for many, the situation is far more dire.

It’s been well-documented how real estate prices have jumped over the last 18 months, especially in places like Florida and Texas, where restrictions have been light.

Perhaps more troubling, rents have been skyrocketing as well. This next graphic demonstrates how serious it is:

Apartment rents are up significantly in every single one of the top 30 U.S. metropolitan areas. And look at Phoenix, Tampa, and Las Vegas – rents are up roughly 20% or more over the last year.

If we’re looking to keep pace with inflation, we’ll receive zero help from traditional savings accounts. Already, the yield we receive is abysmally low.

And as I write, a so-called “high-yield savings account” produces only a 0.65% return. And the average interest rate that we’ll receive in our checking account is a meager 0.06%. If it’s so low, why bother?

Inflation will continue to eat away at the value of our capital so long as it is denominated in fiat currencies.

So today, I’d like to share five ideas that can help preserve and grow our wealth in the years ahead.

Some of these ideas may seem surprising to those who know me as a technology analyst. I’ve included a range of “hard assets” among my five ideas.

Still, I’d encourage us to read the list in full. The last topic is my favorite idea for 2022…

It might come as a surprise to know that I was once a very active precious metals and commodities investor.

I owned precious metals miners. I also traded these miners to see fast returns with options. To this day, I still own a “monster box” filled with one-ounce silver coins.

When I first started investing in precious metals, gold traded for about $400 an ounce. By 2011, gold would sell for more than $1,800 an ounce. At the time, it was an all-time high. I’m happy to say that I did very well with my investments in gold.

Gold and silver specifically have been sought as a refuge from inflation for generations. The logic is straightforward. The U.S. dollar may be “printable”, but gold is not.

Precious metals won’t be an official recommendation in any of my research products. It’s not because I don’t like these assets. It’s just because I don’t believe that they will deliver the kind of high-growth returns that I am looking to deliver to my subscribers.

Assets like gold and silver can be considered as a store of wealth that will at least keep up with the pace of inflation over time. But they’re not my top choices for growing wealth in an inflationary environment…

My second idea to preserve and grow our wealth in the years ahead will probably come as a surprise. It’s timberland. That’s right. It’s land… with trees on it.

Timberland can be a great asset to help preserve and grow our wealth. For starters, the asset is not correlated with stocks. Timberland can also produce a reliable income stream. We can harvest portions of our forest at regular intervals.

A large enough parcel of timberland can actually be managed to produce annual harvests that will produce regular income. And that income can more than cover taxes associated with the land.

After a period of time, timberland investments can also produce large capital gains.

For example, the value of timberland in the Pacific Northwest – as measured by the NCREIF Timberland Index – returned 14.42% last year.

I recently had dinner with a colleague of mine who purchased a large piece of property in rural Michigan. He commissioned a forester to survey his land. He was told that he could reclaim close to 30% of his purchase price by selectively harvesting the trees on his property. Bear in mind, this didn’t mean harvesting all the trees, but just “tidying up.”

In this environment, I’m actively looking into the idea right now. Perhaps one day I’ll have my own forest to manage and harvest.

And I have to say, there’s something appealing about owning our own plot of timberland and watching our investment – literally – grow in front of our own eyes.

Along the same lines as timberland, agricultural land can be a great way to insulate our wealth in the years ahead. Many would argue that food and water are our most essential “assets” for life.

And similar to timberland, agricultural land is a “real” asset. Unlike fiat currency, these types of assets will keep pace with inflation

With the invasion of Ukraine, I predict, sadly, that the world is on the verge of serious food shortages. In developing countries, especially, we could be looking at a literal famine in late 2022.

That’s because Ukraine and Russia together supply roughly one-quarter of the world’s wheat. Every year, 32 million hectares are cultivated within the Ukrainian border. The area has long been known as the “breadbasket of Europe” for this very reason.

At the same time, the sudden supply shock for natural gas is having knock-on effects on agriculture. Fertilizer, a key component to promoting soil health, requires inputs like urea and ammonia.

Both molecules are derived from natural gas and can account for 40–70% of the cost to produce agricultural fertilizers. As natural gas soars, the price of fertilizer has gone vertical.

The Green Markets fertilizer index – which tracks a blend of global fertilizer prices – shows that the cost of fertilizer has soared 118% since this time last year.

All of this suggests that the prices for agricultural products are about to go higher… perhaps much higher. And we can safely assume the value of food-producing land will rise as well.

My fourth idea is to invest in high-quality digital assets, which many investors refer to as cryptocurrencies. However, that does not mean we should purchase just any digital asset.

We want to find assets that have a well-defined monetary policy. And, ideally, we want to find an asset that has a limited supply.

Bitcoin, the world’s first digital currency, fits this description perfectly. I first profiled bitcoin in June of 2015 when the asset was trading for just $240. At the time, cryptocurrency was not well understood.

And while many just saw a speculative asset, I pointed out that bitcoin does in fact have intrinsic value.

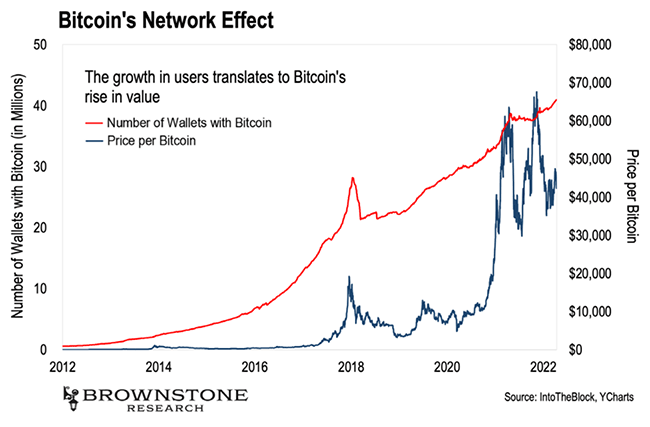

I’ve heard on several occasions that bitcoin is “backed by nothing” and therefore worthless. This could not be more wrong. In fact, we can “see” bitcoin’s intrinsic value with one chart.

What we see here is bitcoin’s price – through the beginning of 2022 – compared to the number of wallets that hold the asset. In other words, this is bitcoin’s “network effect.”

The idea of valuing a network was best summarized by the famous Metcalfe’s Law. The law states that the value of a network is proportional to the square of the number of connected users.

Put another way, as more users join a network, the value of that network grows exponentially. This is bitcoin’s intrinsic value.

Yes, bitcoin can be volatile. But over the long term, quality digital assets like bitcoin have appreciated far faster than the current rate of inflation. It will continue to do so.

Last month, I attended a special investment conference with my subscribers. During the event, I shared this chart.

What it shows is how much wealthy investors are allocating to private investments.

And what we’ll see is that wealthy investors and family offices have nearly half of their portfolios in private investments.

Endowment funds have more than half of their portfolios in private investments.

Meanwhile, the average retail investor has zero percent. That’s right. Nothing at all.

So, why are wealthy investors putting nearly half of their capital into private companies?

It’s because they know placing small investments into the right private companies can create generational wealth. This is my favorite way to protect and grow our wealth.

And there’s one type of private investment we should be paying attention to.

I call them simply: Crypto Placements.

Crypto placements are where private investing meets cryptocurrencies and blockchain technology. And it’s where the largest returns will be seen in the years ahead.

These private cryptocurrency and blockchain companies are being funded right now. And we are at the beginning of sustained exponential growth in the adoption of blockchain technology.

And I would like to guide us through the exciting world of private blockchain investing.

And it all starts on Wednesday, May 18, at 8 p.m. ET.

On that night, I’ll be hosting a special investment summit to profile what “crypto placements” I’m currently seeing in the market, including a new private recommendation I’ll be making in the coming weeks.

So, if we are at all interested in entering the exciting world of private investing, I’d invite you to join me. Simply go right here to reserve your spot.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.