Dear Reader,

For those of us who have school-age children, perhaps we can commiserate together. We enter the second half of August this week. Many of our children should be at school but aren’t. We are trying to figure out a way to help our children develop intellectually, physically, emotionally, and socially.

Sadly, in most of the U.S., schools are not at all returning to normal in the coming weeks. Many will not open at all and will continue with remote learning.

A few days ago, I learned that my district will only return to on-campus schooling two days a week, with two days of primarily synchronous “learning” where children scroll through a slide deck and are given tasks. That is not an effective method of learning for young children.

The announcement led me to pull one of my boys out of the district. I’ll be sending him to a school that has the fortitude and sense to keep elementary-level children in school five days a week.

As for my younger son, I’ve been exploring a new trend that has risen from the pandemic called “micro-schools.” And it may very well be here to stay.

Micro-schools tend to be 3–10 children per teacher. They can be formed by those working in education and teachers themselves, an education-focused therapist team, or a group of parents who band together and recruit a teacher to run the micro-school.

If we think about the mechanics, it’s not hard to envision a reasonable business model.

If we assume 10 children for a nine-month period at around $5,000 per child, that’s $50,000 to support a teacher, materials, and a teaching space (which could be as simple as someone’s basement). At $7,000 a child, that could provide enough to support a stronger teacher and/or a small rental space.

These are just rough numbers, yet they seem to be a reasonable alternative to homeschooling (where the burden falls to the parents) or a private school (where the $40–50k tuition can be very cost prohibitive).

Micro-schools can be designed to augment the kind of hybrid model that is popular in many places (two days a week at school and the rest remote). Or they can be a way to entirely replace the public school system.

They provide small class sizes, healthy socialization with other kids, a smaller group to interact with, and more reasonable rates than a private school. And the parents can actually have control over the quality of the teacher.

I’ve been speaking with parents across the country. They are all struggling with the same challenges. It is heartbreaking to watch the emotional and developmental distress caused by keeping schools partially or fully closed.

I caught a very interesting webinar a few days back with Robert Redfield, MD, director of the Centers for Disease Control and Prevention (CDC). When speaking about the actual risk to school-age children, he said, “The risk per 100,000, so far into the outbreak, six months into it… we’re looking at about 0.1 per 100,000. So another way to say that… it’s one in a million.”

He continued on to compare that to the influenza: “If you do the same thing for influenza deaths for school-age children over the last five years, they’re anywhere from five to 10 times greater.”

And the saddest comment that he made was this: “But there has been another cost that we’ve seen, particularly in high schools. We’re seeing, sadly, far greater suicides now than we are deaths from COVID. We’re seeing far greater deaths from drug overdose… than we are seeing the deaths from COVID.”

Absolutely heartbreaking. The shutting down schools is causing more deaths than COVID-19 itself.

Again, these comments were from the director of the CDC. It is nearly impossible to understand what kind of decision making is happening at the state level. We have to get the kids back in school.

I’m sending my best wishes to all of the parents out there who are struggling with any of these issues. I know it hasn’t been easy.

Now let’s turn to today’s topics…

We are going to start today with some big news in the quantum computing space.

As regular readers know, Rigetti Computing is one of my favorite early stage quantum computing companies. Rigetti is one of the top players developing a superconducting quantum computer. This technology has the potential to become a universal quantum computer capable of solving any problem.

That’s the holy grail of quantum computing – a universal, fault-tolerant quantum computer.

Rigetti just raised a cool $79 million in its Series C venture capital (VC) round. And what was especially interesting was who invested in the round.

Of course, some of the typical VC firms participated: Bessemer Venture Partners, Northgate Capital, Battery Ventures, and others – no surprise there.

But tucked in among these early stage VC firms was Franklin Templeton Investments. Franklin Templeton is a major investment firm that also runs several mutual funds.

We normally don’t see these large investment firms come in until an early stage company is getting ready to go public.

But that’s not the case here. Rigetti isn’t ready for an initial public offering (IPO) – it is still in heavy research and development mode.

From my perspective, it’s too early to be looking at IPO.

While this kind of investment is unusual for a firm like Franklin Templeton at this early stage, I see this as an indication of how high the level of interest is in getting exposure to quantum computing technology. After all, there just aren’t that many companies out there to invest in, and almost all of them are still private.

Given the amount of progress made in just the last 12 months, I see a clear path toward accelerated development in this space. Any company developing a promising approach to quantum computing – or quantum cryptography, for that matter – will not have any problem raising as much capital as it needs.

The way we can think about quantum computing is that it is the next generation of high-performance computing technology. It means that Moore’s Law will remain intact. In fact, computer processing power will increase at a rate faster than Moore’s Law with the advent of quantum computing.

And that means it is only a matter of time before we have quantum computers that can be used to solve a wide range of problems that we struggle with today.

I’m talking about things like weather predictions, molecular analysis, protein folding, genetic analysis, nuclear fusion, cosmology – quantum will tackle all of it. And quantum computing will supercharge artificial intelligence (AI) as well.

Simply put, quantum is a game changer.

Think about how much our world changed with the adoption of classical computers in the mid-20th century. Or consider the significance of the personal computer (PC) revolution in the 1980s and ’90s. These technologies transformed our society in ways that few could have predicted at the time.

Quantum computing will do precisely the same thing. But the impact will be far more powerful.

And it won’t take decades. We’ll see profound changes thanks to quantum computing in a matter of years.

That’s why we must track developments in this space. Stay tuned to these pages for all the latest on quantum…

Square (SQ) is one of my favorite companies in the payment space.

I am such a fan of this company that I recommended the stock to readers of my large-cap investing service, The Near Future Report, in April 2019. And before that, I recommended it in my small-cap service, Exponential Tech Investor, back in August 2016 when it was trading around $11.50 a share. Square is now trading for around $152 a share.

Most people know Square as the company that provides the little white credit card terminals for shops and local businesses to take payments. They are simple and easy to use. And Square has built a great business around these terminals.

But with the COVID-19 lockdowns, many of those businesses were forced to close. Many analysts predicted this would spell doom for Square. And the stock did fall by as much as 58% during the fear-induced selling we saw earlier this year.

But I recommended that my readers hold on to Square and even establish a position if they hadn’t already. And that decision has been vindicated.

Square just announced its second-quarter earnings, and the results were fantastic.

How could that be?

A lot of it comes down to Square’s Cash App.

The Cash App is my favorite peer-to-peer payment application available today. The design is clean. It’s simple to use. And it enables users to send dollars back and forth, just like top competitor Venmo.

Except Square has a trick up its sleeve that Venmo doesn’t…

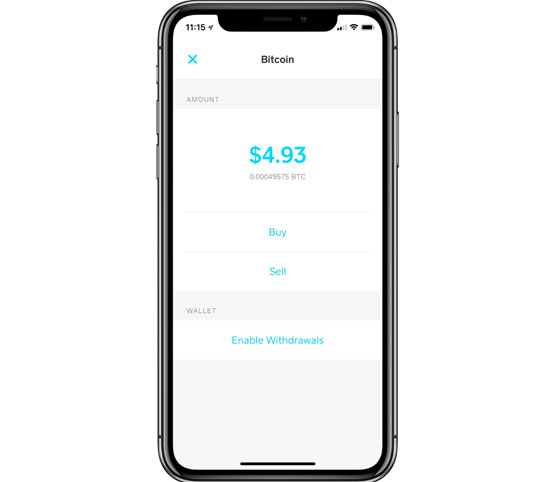

The Cash App also allows users to buy and send digital assets like bitcoin. And it makes dealing with digital assets so simple that anyone can do it.

Just type in how much bitcoin you want to buy, press the button, and boom – it is done. The bitcoin shows up in the Cash App instantly.

Buying Bitcoin With Cash App

Source: 9to5mac.com

In my original recommendation for Square, I referred to the Cash App as a Trojan horse because Square developed it largely under the radar.

It didn’t appear to be a big part of Square’s business. In fact, the Cash App accounted for only 20% of Square’s revenue in the second quarter of last year.

Fast forward to today, and the Cash App accounts for 62% of Square’s revenue. Its growth over the last four quarters has been astonishing.

And much of that growth is due to bitcoin. Square customers have purchased over a billion dollars’ worth of bitcoin so far this year. That’s compared to just $516 million for all of last year.

As a result, Square generated $875 million in net revenue on bitcoin transactions. In total, the Cash App generated $1.2 billion in revenue this quarter.

The Trojan horse worked perfectly. The investment thesis is playing out exactly as I predicted.

Square has been such a remarkable success story. We’re up nearly 90% with Square in our model portfolio in The Near Future Report. And investors who established a position during the irrational selling of March have done even better. I suspect plenty of readers have more than doubled their money on this investment.

Speaking of mobile apps, we have to talk about Robinhood’s incredible success.

We first pulled the curtain back on Robinhood back in June. To bring new readers up to speed, this is a VC-backed brokerage firm that’s geared toward millennials.

Its smartphone app lets users trade in the stock market easily. And Robinhood does not charge commissions on its trades. It advertises itself as a “free” stock trading service.

Of course, nothing is ever free.

As we highlighted in June, Robinhood has a dark secret. It routes its customers’ orders through hedge funds for execution.

The hedge funds then front-run those orders by buying shares at a lower price and selling them to Robinhood’s customers at a higher price. This isn’t illegal, but it’s certainly not a commission-free trading model. Users still pay to trade; it just doesn’t show up on their brokerage account as a commission or fee.

And, of course, the hedge funds pay Robinhood handsomely for this service. That’s how Robinhood makes money. Hedge funds pay it for order flow.

Regardless, consumers have flocked to Robinhood. The company has attracted three million new customers so far this year.

And as it turns out, more trades happened on Robinhood’s platform in June than any other brokerage house. Incredible.

Robinhood announced that daily average revenue trades (DARTs) were 4.31 million in June. TD Ameritrade was a distant second with 3.84 million DARTs. It was followed by Interactive Brokers with 1.86 million. And bringing up the rear were Charles Schwab and E-Trade with a measly 1.8 and 1.1 million, respectively.

What’s so incredible about this is that Robinhood has only been around for seven years… and it is already trouncing the incumbents that have been around for decades.

I don’t like Robinhood’s business practices. But this is an incredible success story. And it demonstrates something important…

In these pages, we’ve profiled several early stage technology companies that are shaking up decades-old industries.

Whether it’s Robinhood disrupting the online brokerages…

… the AI-powered Lemonade upending the insurance industry…

… or even SpaceX and Tesla putting legacy incumbents in the aerospace and automotive industry to shame…

We’re witnessing massive disruption across just about every industry.

And these trends are accelerating. My readers can expect we’ll be targeting the technology companies that are at the center of this disruption. That’s where we’ll find the best investment opportunities.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.