|

Folks, it’s coming.

The end of the pandemic is in sight.

Don’t believe rumors about new secret COVID variants in the sewer water. Cases of Omicron are falling in 49 states. Hospitalizations are down. Deaths are falling.

Ireland has just canceled its pandemic designation. Countries in Africa are following suit. And even several U.S. states are dropping mask mandates and other restrictions.

The end is near.

As a result, I believe we’re going to see a big boom in stocks during the second half of this year.

And it means one investment sector in particular looks very interesting right now…

The sector I’m talking about is the real estate industry.

I’m sure many of you know that the housing market has exploded in the past couple of years.

Home prices spiked in metro areas. Rents are soaring. Sight-unseen buying became commonplace in the COVID era.

Sites like Zillow Group and Realtor.com saw a huge influx of traffic. Exciting new versions of brick-and-mortar real estate brokers cropped up and exploded.

eXp World Holdings offered virtual walkthroughs of homes, after entering a virtual lobby and meeting your broker on the internet. This facilitated the buying process and made everything more comfortable.

Prices began to skyrocket for individual homes in other areas too.

Here in South Florida, home prices went through the roof. Median home prices in Palm Beach County, for example, rose as much as 24% in a single year. Tighter COVID policies in places like New York City and California caused a new migration to looser areas like Florida.

Not all real estate is up, though.

And that’s where we’ll find our opportunity right now…

Unlike housing, commercial real estate has been depressed for a while.

The pandemic forced people to stay home from work. Office buildings emptied out. Construction on new commercial real estate projects ground to a halt. This slowing of new developments is actually affecting the U.S. GDP.

Of course, this is not surprising.

But as I mentioned at the beginning, the wheels are firmly in motion to restart the U.S. economy and get us back to normal.

A few things have to happen first…

First, inflation has to start cooling. With scary language about tightening rates, the Fed essentially did just that.

Asset prices such as stocks and crypto have fallen heavily since the start of this year due to fears about the Fed raising interest rates. Yet this is a synthetic way of tightening the money supply and calming inflation without actually raising interest rates.

I think that’s been the Fed’s plan all along… so I think the threat of higher interest rates is overstated right now.

That’s important. Higher interest rates on loans for commercial property development could eat into margins or force developers to raise prices to absorb it. So that could be a headwind for commercial real estate development.

Yet the Fed can’t raise rates too high, too fast without shooting themselves in the foot when it comes to servicing our country’s debt. So at max, they will only raise rates three times in 2022 to a target rate of only 0.75–1.00%.

Next, America must get back to work. With more labor available, supply chains will ease, and prices will come down.

In order for this to happen, of course, everyone needs to feel safe to go back to work. I believe an announcement is imminent. The government will officially say that COVID-19 is no longer a pandemic.

This will enable Americans to get back to work and start the engines of real economic growth.

And that’s where the opportunity lies for commercial real estate.

Once people get back to work, new commercial real estate projects will begin. The residential boom we’re seeing will also lead to a commercial boom. Growing residential areas will need access to new malls, doctors’ offices, and retail stores.

Growing cities and towns will need new infrastructure. They’ll also need new power plants and factories.

All this will help boost the economy.

And even better, commercial real estate shares of public companies are still low now.

This sets up for a nice entry point for investors to get in on a potential commercial real estate boom…

So now is a great time to invest in commercial real estate development. But how should we play this opportunity?

One great way is by scooping up a basket of stocks concentrated in the real estate space. The easiest way to do that is to buy an exchange-traded fund (ETF).

ETFs hold a bunch of stocks like a mutual fund, but they trade on an exchange like a stock. You can buy or sell whenever you like, all while getting exposure to an entire industry.

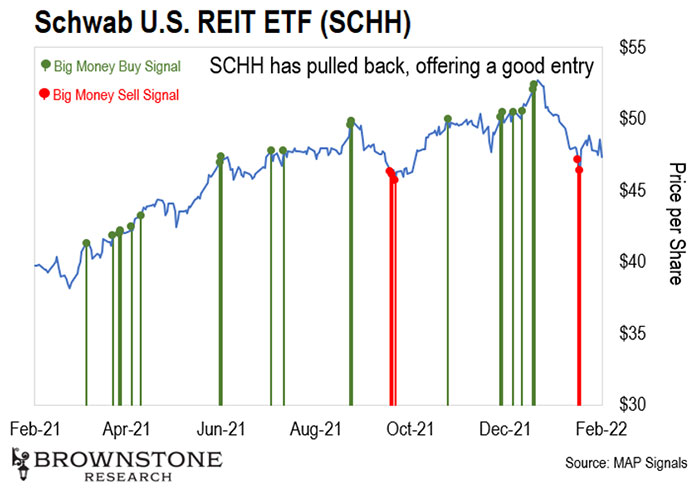

The Charles Schwab US REIT ETF (SCHH) is a great example. Its prior peak was February 17, 2020, at $48.53. It briefly eclipsed that last December, but it’s down since then.

Even better, it holds an impressive collection of stocks: telecommunications businesses, commercial real estate development, personal storage companies, and more.

It is a good size with $6.8 billion of assets. And while it is a little less liquid than some of the more well-known ETFs out there (meaning it trades fewer shares), it still has an average volume of a million shares a day.

Plus, Big Money institutional traders have been buying it and lifting it higher.

The recent selling offers us an interesting entry:

Of course, an ETF is just one way to play this trend. I’ll also be sharing specific companies that come across my radar in my research service, Outlier Investor.

There, I target the outliers that will outperform all the rest – the cream of the crop – using my proprietary system. I follow the Big Money and search out companies with strong earnings, low debt, and promising technical setups.

I’d love to have you join me. So if you’d like to learn more, you can go right here for the full story.

The world is about to resume some degree of normalcy. I believe now is an excellent time to look forward to the future – and a great time to get into commercial real estate.

Talk soon,

Jason Bodner

Editor, Outlier Investor

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.