Dear Reader,

We have to wonder if “they” really thought things through.

As the western world goaded and poked at Russia as if it was a caged bear, it was quick to react with righteous indignation when the beast bit back.

Sanctions were quick to follow, as were the spiking prices of oil and natural gas. This has been compounded greatly by inflation caused by irresponsible monetary policy. We’re all feeling the pain at both the gas pump and from our electricity providers.

But these are just the beginnings of what’s to come… These problems are what we can see right now, but what comes next is far more serious.

The bigger problem is that Russia and Ukraine provide the world with:

30% of wheat exports

17% of corn exports

32% of barley exports

75% of sunflower seed oil

Making matters worse, Russia and Belarus are the world’s second and third largest producers of potash, which is the key component in making fertilizer for agriculture.

Food prices are rocketing. In the U.S. alone, they’re up 8.6% in February year-over-year. And it’s going to get worse.

Food shortages are already happening around the world as several countries rely on Russia and Ukraine for all or most of their wheat imports.

Other food-exporting countries are starting to hoard food as they simply won’t be able to import as much this year as they normally would.

And China experienced floods that have already reduced plantings for this year’s crops, which means less to export.

Ukraine doesn’t have the fuel to plant its crops, as all fuel has been diverted to the military. Large swaths of agricultural land are also in the war zone. The country’s own crops this year will be devastated as a result. It’s obvious to say, but we shouldn’t expect any exports to follow.

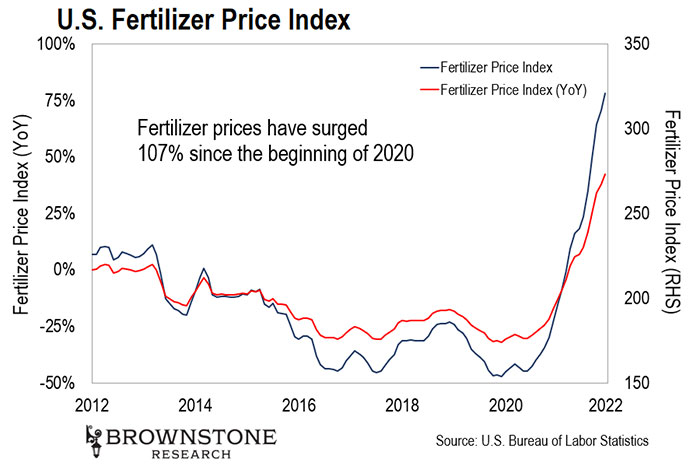

And farmers are planting this year’s crops with dramatically less fertilizer. Not only is there less fertilizer to go around, but prices have also gone through the roof.

Less fertilizer means lower crop yields come harvest time in the late summer/early fall. This will further exacerbate food shortages and cause rising food prices.

It’s going to be painful for the developed world. It will be far worse for developing countries, especially those that don’t have a vibrant agricultural sector.

Before COVID-19, we had peace, abundance, and the most successful economy I’ve seen in my lifetime. Then we were slammed into a real pandemic, but an orchestrated and ineffective pandemic response.

And with the pandemic collapsing, as most of the population has figured out that the emperor has no clothes, now we have this… I doubt the timing is a coincidence.

The puppet masters are not doing a good job. It’s too easy to see their hands tugging at the strings. And they’re obviously making things a whole lot worse.

It is saddening, heartbreaking, and criminal. The toll on human life and our freedoms is hard to comprehend.

What were they thinking?

SiFive is a rapidly moving up-and-comer in the semiconductor industry that we’re going to keep a close eye on. I thought the company was going to suffer an early demise as it was considering being swallowed up by Intel last summer. Fortunately, the discussions fell apart.

SiFive is positioned as a viable alternative to ARM – the U.K.-based company that we have been tracking closely in these pages.

As a reminder, ARM designs semiconductor architectures primarily for lower power consumption and devices that operate at the edge of networks. Then ARM licenses this technology out to other semiconductor manufacturers.

And ARM has been incredibly successful. Companies rapidly adopted its tech over the last decade for applications in the automotive industry, smartphones, tablets, smartwatches, gaming consoles, and Internet of Things (IoT) applications. These are all high-growth areas.

This prompted semiconductor giant NVIDIA to make a $40 billion offer to acquire ARM back in September 2020.

But as we discussed last month, that deal fell through. NVIDIA couldn’t get regulatory approval for the deal. The regulators felt the acquisition of ARM would make NVIDIA the de facto gatekeeper to the entire industry.

So ARM will remain independent and likely pursue its own IPO.

Given ARM’s competitive position, it could certainly make for an attractive investment at a reasonable valuation. But the industry has mixed feelings about ARM’s position in the market… The technology is fantastic, but because its position is so strong, it has the upper hand in pricing.

That’s where SiFive comes into play.

SiFive uses the same kind of RISC-based semiconductor architectures as ARM. However, SiFive’s business model is to use open-source RISC architectures, whereas ARM’s RISC products are proprietary. SiFive is attractive in the industry because its licensing models are less expensive than ARM’s proprietary models – where ARM has a tighter control over design.

Aside from the difference in business model, SiFive’s go-to-market strategy has largely been centered around semiconductor architectures design to optimize and improve performance for artificial intelligence and machine learning applications.

This is a smart strategy given the stage of SiFive right now. There is no need to compete head-to-head at the moment with ARM, and the AI/ML-related semiconductor industry is one of the fastest-growing markets in high-tech right now.

What’s more, SiFive just raised $175 million in a Series F funding round. This round put SiFive’s valuation at $2.5 billion… a sharp appreciation from its August 2020 Series E round done at a $491 million valuation.

My guess is that Intel and SiFive were unable to come to an agreement on valuation last summer and that’s why the deal fell through. That’s likely good news for investors, as several late-stage investors participated in the Series F round. This raises the possibility of an IPO within the next 24 months.

Having a strong counterbalance to ARM in the industry would be great for innovation and ultimately consumers, and hopefully in time for investors as well.

But there is one more kink to this story…

The venture arm of Xilinx was one of the late-stage investors in SiFive’s Series F round. Xilinx is a fantastic semiconductor company that we successfully held in The Near Future Report portfolio several years ago. Then Advanced Micro Devices (AMD) acquired Xilinx for $35 billion in October 2020.

As regular readers know, AMD is NVIDIA’s number one competitor. And with Xilinx taking a strategic position in SiFive, AMD could be positioning itself to acquire the company outright.

That would be a huge move.

If AMD strikes early enough, before SiFive gains material market share in the industry, then the regulators would likely approve the deal.

That would seriously strengthen AMD’s competitive position in the industry and would prove to be a shrewd move by AMD as a contrast to NVIDIA’s failed acquisition attempt of ARM.

Google just acquired an early stage company called Raxium for $1 billion. This acquisition tells us a lot about where Google is focused this year.

Raxium specializes in micro light-emitting diodes (LED) technology. Specifically, Raxium develops micro LEDs for small mobile devices… including augmented reality (AR) lenses.

Google wants to incorporate Raxium’s tech into the lenses for its upcoming AR eyewear product. This is all about jockeying for position in the race for widespread consumer adoption of AR.

In order for that to happen, AR eyewear needs to be sleek and form-fitting to gain adoption. People don’t want to walk around wearing big bulky headsets. So AR eyewear needs to be closer to a nice pair of sunglasses than a big pair of goggles.

So all AR eyewear will likely look and feel very similar. And the components inside the eyewear will largely be the same regardless of who is making these products.

But where the large consumer electronics manufacturers are investing heavily, in their own proprietary implementations, is on the AR lens technology. It’s not surprising. The lens performance is so critically important to the experience of using AR technology.

This focus actually started with Magic Leap – one of the early movers in the AR space. Magic Leap developed a proprietary lens design that it felt was so strategically important that it handled the manufacturing in-house so nobody else could get a read on it.

Magic Leap took in billions of dollars of investment to fund the development and manufacturing of its lens technology.

Consumer electronics giant Samsung does the same thing. It designs and manufactures its own micro-LEDs.

This prompted the other major players in the AR race to step up their game.

Apple acquired micro-LED startup LuxVue back in 2014 to get a jump on its lens technology. And Facebook bought British micro-LED company Plessey in 2020 to power its AR tech forward. Now Google is following suit with the Raxium acquisition.

These moves are all about choosing a proprietary approach to AR lenses in hopes of gaining a competitive advantage. I can’t wait to see how it plays out.

For Google, winning is critically important for its advertising business. Just like with smartphones, Google wants to own the majority of the operating systems used in AR. It is employing the same strategy that it used with Android… It can’t afford to let Apple or anyone else get a leg up.

So 2022 is shaping up to be a big year for augmented reality.

We know Apple is gearing up for a big launch in the fall. I wouldn’t be surprised to see something from Samsung or Facebook later this year as well… And Google won’t be far behind at all.

And regardless of who the “winning” design comes from, my readers will be prepared to profit… To learn more about the best way to invest in this trend, go right here for the details.

We’ll wrap up today with an interesting development in the digital asset space. It centers around a new cryptocurrency called ApeCoin (APE). I recognize that this might sound like another useless meme coin, but I assure you it’s not.

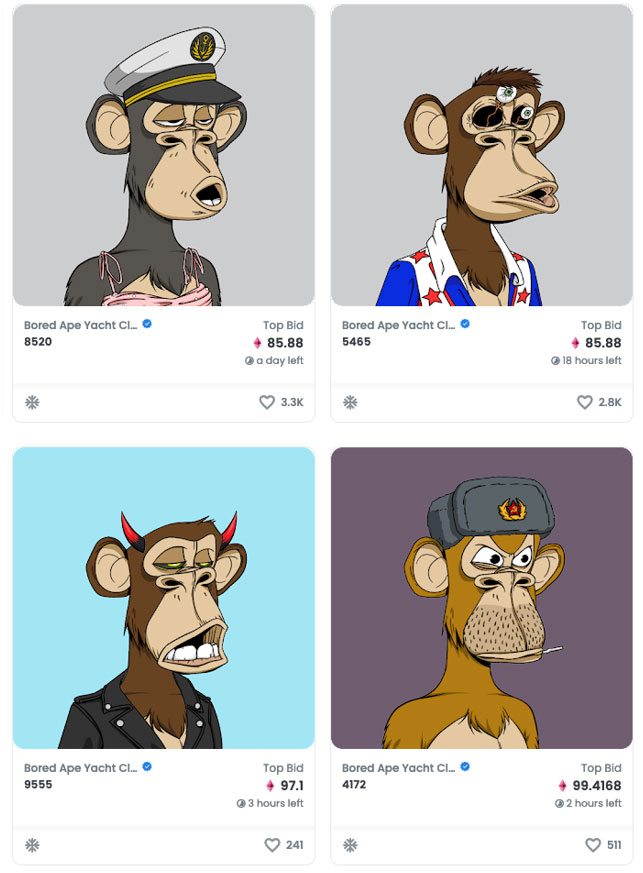

ApeCoin is associated with the popular Bored Ape Yacht Club non-fungible token (NFT) franchise. As a reminder, this is one of the most valuable series of NFTs that have been created.

There are only 10,000 Bored Ape NFTs in existence. And the cheapest ones are selling for over 85 ether (ETH) on OpenSea right now.

Bored Ape NFTs

Source: OpenSea

At today’s price, that’s roughly $250,000 per NFT… Not many people out there can afford to pay $250,000 for one of these NFTs.

At the same time, a lot of people now recognize the Bored Ape brand. There’s a tremendous commercial opportunity associated with the brand.

However, the franchise cannot mint any more Bored Ape NFTs. Doing so would dilute the value for every existing NFT holder, and it could cause investors to lose faith in the franchise altogether.

That’s where ApeCoin comes in. ApeCoin features an innovative design that will make the Bored Ape brand accessible to all investors. Here’s how it works…

It all starts with a decentralized autonomous organization (DAO). We can think of DAOs as something like limited liability companies (LLCs) in that they are set up for a specific function.

The difference is, DAOs have no executives, no management teams, and no offices. They pool capital and allow the contributors to vote on what tasks to perform.

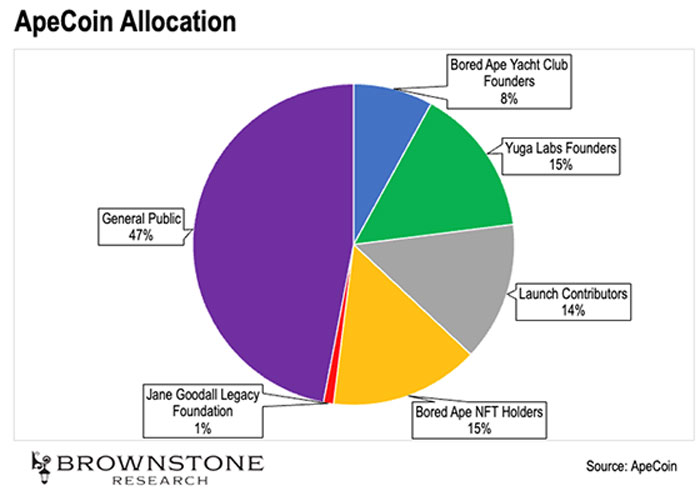

In this case, the ApeCoin DAO created the ApeCoins. And similar to other blockchain projects, here’s how the ApeCoin DAO will distribute the ApeCoins:

As we can see, 47% of the ApeCoins created will become available for purchase to the general public. 52% will go to the founders who created and contributed to the project.

And look at the final 1% – it’s allocated to the Jane Goodall Legacy Foundation. This is a charity that, among other things, runs programs to support chimpanzees and gorillas in their natural habitats.

I got a chuckle out of this. Over half of the ApeCoin allocation goes directly to insiders. Whenever we see a project that’s self-serving like this, we almost always see an allocation to a charity as well. That’s designed to deflect attention and generate goodwill.

This is where I must issue words of caution. Clearly, those originally involved with the project are going to be greatly enriched with the launch of ApeCoin… hopefully not at the expense of Bleeding Edge subscribers. There has already been a rash of selling by insiders cashing out on the launch.

That said, the ApeCoin launch will create a much larger network around the Bored Ape franchise. Right now, only 10,000 people own Bored Ape NFTs. But hundreds of thousands – or even millions of people – could own ApeCoins.

As more and more people join the ApeCoin network, the franchise can host events and special offerings to help tie APE holders to the franchise even more. This helps build a community around the franchise.

And then they can launch new NFT brands within the Bored Ape franchise. If successful, this would help drive the price of APE higher.

If we think about it, this is exactly what the big fashion houses have done for years. They start with a high-end brand. And if it catches on, they gradually create new sub-brands geared toward the mass market.

So this is going to be an interesting project to watch.

If ApeCoin pulls this off, we will see many other digital asset franchises apply the same model. This model actually drives wider participation and potentially network effects. That could lead to some great investment opportunities in the future.

Digital assets like these are more speculative in nature. They are better suited for trading compared to long-term investing.

I’m focused on exactly these kinds of trading opportunities in my newest research product. As a reminder, last Wednesday, I launched the first-ever crypto trading service at Brownstone Research.

This research service is called Neural Net Profits… because it operates based on an advanced artificial intelligence (AI) called a neural net. It works similar to our brains… and it learns as it goes.

In testing, this system led us to potential profits as big as six figures… in just around 60 days. And now it’s already issued our first three trades to subscribers… with more on the way.

So if you haven’t yet caught the replay of last Wednesday’s launch, please be sure to do so soon.

You can go right here to watch.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.