Dear Reader,

Microsoft was one of the very first companies to announce that all of its employees would work from home almost a year ago to the day. It was quick to do so in the early stages of the pandemic.

I remember exactly when it happened. I was in Washington D.C. on a business trip doing some boots on the ground research. I was investigating the performance of the capitol’s 5G wireless networks. My trip was surreal.

It was at the height of panic and uncertainty. The streets were empty. I was staying at the Willard InterContinental Hotel, which is right off the National Mall and just a short walk to the White House.

The hotel was completely empty. My team and I had the entire place to ourselves. Most of the time, there wasn’t even a single hotel staff member in the front lobby.

We walked the entire National Mall from the Capitol building to the Washington Monument, and we probably came across five people the entire way. People were even scared to go outside.

It felt like the world was going nuts, with news breaking by the hour.

That’s why I remember the Microsoft announcement so well. When the large tech firms started to require employees to work remotely – whether it was a rational decision or not – I knew that similar policies would spread quickly and persist throughout the pandemic. There was no going back.

And that’s why Microsoft’s announcement yesterday caught my eye.

While still laden with a ridiculous amount of what I loosely refer to as “safety culture” language, the message was very clear. The company is taking concrete steps to psychologically prepare its workforce to return to the workplace.

The company also announced that it is officially moving to a “soft open” of its offices on March 29.

This is the start of what will be announcement after announcement of a return to the office for companies across the country and the world. And that will provide a far more normal work environment for all of us.

Microsoft’s Six Stages of the COVID-19 Hybrid Workplace

Source: Microsoft

We can easily understand why Microsoft is employing a staged reopening approach. People have been sadly and wrongly mislead with fear and panic.

And many have been given conflicting information on just about any topic related to COVID-19 we can imagine. I’ve lost count of how many times Dr. Fauci flip-flopped on his positions over the last 12 months, recommending that we do things that are exactly the opposite of what he previously recommended we do.

I wouldn’t blame anyone for struggling to make sense out of all the nonsense. Which is why Microsoft is trying to get back to an in-person work environment.

I’ve been monitoring research and surveys on workplace productivity in a remote work environment. They are all over the board.

For some roles, especially those that are heavily dependent upon individual performance, productivity has increased.

Of course, this has mostly been the result of longer hours. Commute time was replaced with more work time, and many people have realized that they are working more now than they were before.

Other roles where teamwork is a necessity have seen declines in productivity. While Zoom may be the best tool that we have right now for collaboration, it still stinks compared to in-person collaboration.

And the reality is that companies – especially publicly traded companies – will still be measuring and optimizing for performance. This alone will drive a return to the office. And that’s especially true for those roles that benefit from us regularly being in the office, laboratory, or manufacturing plant.

What I did like about Microsoft’s announcement yesterday was that it provided a view of what a post-COVID-19 work environment will look like.

Yes, most people will absolutely return to an in-person work environment.

We’ll also continue to see a lot of unnecessary practices carry over from the pandemic like the seating arrangements, plastic dividers (which do absolutely nothing), and sanitization efforts on surfaces. Ironically, research has already shown that COVID-19 rarely ever spreads from surfaces.

But what is positive is that those roles where remote work is suitable and productivity can remain high will persist. Employees who are willing to do so will be empowered to do so.

Not surprisingly, Microsoft was talking its game around its Microsoft Teams product with its “Together Mode” and its “Whiteboard” product.

Microsoft will obviously benefit as other companies follow its lead and use its technology to enable this kind of collaborative model. This is precisely why Microsoft has gone to such lengths to publicly demonstrate this “new” hybrid working model.

Yet it will come at a cost to those who choose to remain remote. Many companies in the tech space have been making cost-of-living adjustments to salaries for those employees that move away from headquarters in places like New York, San Francisco, and Seattle to lower-cost cities.

The dream of being able to live in Reno, Nevada, on a San Francisco salary and bank 20% or more in savings every single month is just that – a dream.

We should also accept that upward mobility will be restricted for those of us who choose to work remotely. Whether we like it or not, relationships are still built through in-person interactions.

All of those little things throughout the day that make us feel comfortable with one another haven’t changed one bit. I would argue they are more important than ever.

There are pros and cons to both. But the good news is that the process of vaccination will be largely complete within a few months. And we’ll each be able to make those decisions for ourselves rather than being told what we can or cannot do.

Here’s to freedom.

Now let’s turn to today’s insights…

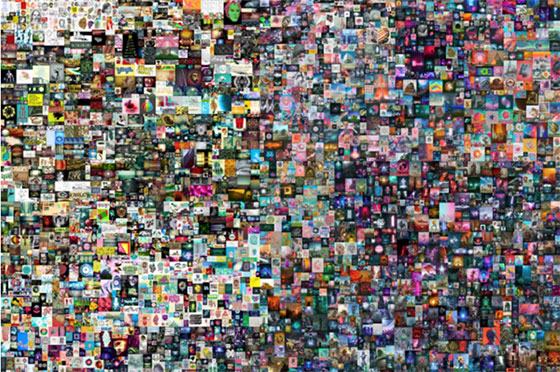

Earlier this month, an artist known as Beeple sold a piece of art for an incredible $69 million. This was the third-highest sale for any artist alive today.

The work was actually a collage of 5,000 individual digital art pieces that Beeple produced. Here it is:

Everydays – The First 5,000 Days by Beeple

Source: Christie’s

The sale was facilitated by Christie’s, which is one of the top auction houses in the world. But there was something unique about this one. The art was entirely digital. The buyer did not receive a physical painting or sculpture to be displayed in a gallery.

Instead, the buyer purchased a non-fungible token (NFT).

NFTs are digital assets that are cryptographically secured and authenticated on a blockchain. In this case, Beeple’s work lives on the Ethereum blockchain.

What makes NFTs different from other digital assets like bitcoin and ether is that only a small number of people can own and access the specific NFT. This limit is defined in advance. In the case of Beeple’s artwork, only one person can own it.

As many readers may know, NFTs have been raging in recent weeks. This is a hot market that’s considered highly speculative. Some – including Beeple himself – say it has reached bubble territory.

But while NFTs may be running hot, this isn’t a passing fad. We can think of these as digital collectibles. Artwork, trading cards, exclusive video clips, poems, and similar items can all be “tokenized” into NFT form and sold as digital collectibles.

And just like there’s been a market for physical collectibles for centuries, we can expect the market for NFTs to grow over time.

In fact, roughly $800 million traded hands in the NFT market last month alone. That was a 29X increase over January. Talk about exponential growth.

I spoke with Glenn Beck on his radio show about NFTs and their explosive growth earlier this month. I pointed out that, because the content sold is authenticated as original by the creator, NFTs allow buyers to verify that they aren’t getting a knock-off. That’s something that the physical collectibles market has always struggled with.

Historically, art collectors have been willing to shell out millions of dollars for individual pieces of physical art. It’s no different with NFTs. These are simply the modern versions of collectibles.

You can listen to my entire chat with Glenn by checking out the video below:

So what we are watching here is the formation of a brand-new market. It’s essentially a digital version of an incumbent “analog” market. Sound familiar?

The infrastructure is being built out before our eyes. There may be booms and busts along the way, but we will see explosive growth in this space.

The NFT market was estimated to be about $250 million last year. That number will easily eclipse $1 billion in 2021. And for those who like collectibles and have knowledge of this space, this will be an interesting place for investment opportunities.

Gaming company Roblox just went public via a direct listing this month. At the time of the listing, the company was valued at an impressive $41.9 billion.

This is a company we talked about last year. To bring newer readers up to speed, Roblox is a multiplayer game that allows mostly kids and teenagers to interact with each other in a virtual world.

Players can “friend” each other inside the game. And they talk to each other over wireless headsets. It’s an immersive social environment.

What’s more, there’s not just one virtual world to hang out in. Third-party developers and creators are incentivized to build customized virtual worlds around acceptable themes on Roblox’s platform.

As a result, Roblox now boasts over 18 million unique virtual worlds that gamers can choose from. And the developers receive a 70% commission on all revenues generated inside of their virtual worlds.

This brings us to the business model…

Roblox is free to download and play. However, gamers are prompted to buy all kinds of items, weapons, clothes, and materials.

These purchases must be made with Robux, which is the official virtual currency of Roblox. And of course, Robux must be purchased with U.S. dollars or other national fiat currencies.

So Robux is a true virtual currency with a specific use case. That makes it comparable to many cryptocurrencies out there.

And this lends itself to the big-picture trend that is important for us Bleeding Edge readers to stay on top of. That is the concept of the “metaverse.” This is a place where people go to spend time in a virtual world while still doing many of the things they would otherwise do in the real world.

The rise of the metaverse will go hand in hand with the development of augmented reality (AR) and virtual reality (VR) headsets.

People will start meeting in a metaverse for both business and personal interactions. They will own real estate in their virtual world of choice. In some cases, that will enable them to set up a shop of some kind and generate income from the metaverse.

And we are already seeing concerts and events happening in the metaverse. We talked about this when nearly 28 million people showed up for the Travis Scott concert inside of Fortnite’s virtual world last year.

Of course, the COVID-19 pandemic was a major catalyst here. Now that so many people are working from home and traveling less, it’s not hard to imagine people “escaping” to a virtual world of their choice. As the functionality improves, more and more people will start spending time, and even being productive, in these virtual worlds.

So we should take highly successful gaming companies like Roblox very seriously. They are signaling that the metaverse is beginning to go mainstream and will have applications outside of gaming.

And Roblox isn’t alone… Second Life is another metaverse that has been around for some time, and Decentraland offers its own blockchain-based version of the metaverse.

What’s fun and interesting about this bleeding-edge technology is that very few people truly understand the size and scale of it.

It may not look like much at first. But when we look at it from an exponential perspective and expand what the product or service can become, we’ll see some amazing investment opportunities in metaverses.

Facebook just announced a vision – almost a road map – of what its augmented reality (AR) product will look like.

And I have to give it credit where it’s due – this is the most comprehensive vision I have seen to date.

We have been talking about augmented reality for years now in The Bleeding Edge. This technology enables us to overlay images, text, and data in our field of vision using either a smartphone or an AR headset.

As regular readers know, I believe AR will be the next mass-market consumer frenzy. And I’ve outlined the various components that somebody must implement into their product to crack the code.

Facebook may have done just that…

Facebook’s vision is to combine AR with an artificial intelligence (AI) assistant, electromyography (EMG) technology, and the facial recognition and speech segregation tech we talked about last week. This will enable all kinds of useful applications.

The AI assistant will link with ear pods, allowing users of Facebook’s AR headset to have conversations with the AI, who will also see exactly what we are seeing. The applications here are almost limitless. The AI will be able to provide us with information throughout the day as we go about our lives.

As for the EMG technology, this comes from Facebook’s acquisition of CTRL-Labs back in September 2019. This is a form of brain-computer interface. It reads electrical pulses coming from the user’s brain whenever the user moves his or her hands and fingers. This enables users to control a computer just by making motions.

In the context of AR, this would allow us to “touch” items in our field of vision to prompt certain actions.

Put it all together, and we have a confluence of technologies that will make Facebook’s AR product more useful than anything else on the market.

What we’re talking about here is the future of computing. This is what comes after laptops and smartphones.

And get this – Facebook has shifted 17% of its workforce to augmented and virtual reality (AR/VR). That’s about 10,000 employees. All of them are working to build out this next-generation computing platform. It’s literally an arms race.

Why is Facebook taking this so seriously? It’s simple.

Google and Apple control nearly 100% of the operating systems for smartphones. Microsoft and Apple control nearly 100% of computer operating systems. Facebook wants to make sure that doesn’t happen in the world of augmented reality.

Better yet, Facebook wants to be in the same dominant positions that Google, Apple, and Microsoft have enjoyed.

Put simply, it wants more of everything – more profits, more control. And it wants to “see” and influence everything that we experience throughout our days and nights.

Like it or not, this is the direction we are heading.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. Once again, thanks to all the readers who showed up to watch my Timed Stocks: Final Countdown investor summit last week.

Now is the perfect time to home in on biotechnology. My pipeline of early stage biotech companies is more robust than it’s ever been.

For readers who haven’t had a chance to catch my presentation yet, the replay will be available for just a few more days. Please make sure you check it out before the video comes down. Just go right here to do so.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.