As an angel investor, I’ve used my personal capital to help fund some of the biggest technological breakthroughs of the last few decades.

Whether I was investing in the financial technology companies enabling us to transact with cryptos… or providing the capital for key semiconductor suppliers that enable us to have fun with products like our smartphones… I’ve made it my life’s work to support the technological megatrends that reflect the way we’ll live next.

And across 300+ private deals, I’ve learned one very important lesson…

The most important innovations often take decades to emerge. The world just needs to wake up to the value of an innovative new technology. Once that happens, we can enter a phase of truly exponential growth.

Regular readers of my work know that I’ve sought to bring attention to the most important technological trends of our time. These include everything from the next generation of the internet and financial services to 5G, quantum computing, and much more.

For a long time, record levels of private capital flowed into startups engineering these transformative technologies.

And we witnessed a generation of exciting tech companies emerge. Companies like Facebook, Twitter, and Apple all created transformative wealth for investors over the last two decades.

But right now, we’re witnessing one of the shakiest stock markets in recent memory…

The stock market sell-off that started last year ended one of the longest-running bull markets in history.

And tech stocks have been one of the hardest-hit sectors. Rising inflation and concerns over higher interest rates have pushed investors out of so-called risky assets like these.

And many potential new tech IPOs have been paused or scrapped completely.

Now make no mistake… This wave of selling has nothing to do with the incredible innovations being engineered by the most exciting startups today.

In fact, I’ve never been more bullish on the tech megatrends I follow across my newsletters. And I’m still investing my capital even during this downturn.

That’s because the most important technological trends – the ones that have the potential to create truly generational wealth for early investors – are not going away.

We shouldn’t allow the current volatility to push us out of these opportunities. Like I said, exponential growth takes time. Even the most extreme market volatility won’t change that.

So while the market is pulling back, there are many reasons to believe a resurgence is underway for tech stocks. And there’s one sector I’d like to direct our attention to right away…

I’ve discovered an opportunity to get in on the ground floor of one of the most exciting trends powering the future of transportation.

I’m talking, of course, about electric vehicles (EVs)…

While it may seem like there are more electric vehicles on the streets today than ever before, we’re really at the very beginning of a whole wave of global EV adoption.

The last decade has seen a crop of exciting EV companies reach the public markets… And over the years, I’ve put my capital to work in those companies fueling the rise of EVs.

I’m also proud to say that I’ve recommended the companies influencing the direction of the entire industry to my readers. Everything from semiconductor firms developing bleeding-edge chips for EVs to the software developers enabling self-driving systems in cars.

In the past, I’ve recommended companies like NVIDIA, ON Semiconductor, and even Tesla to my readers to capitalize on this trend.

And my foresight has paid off…

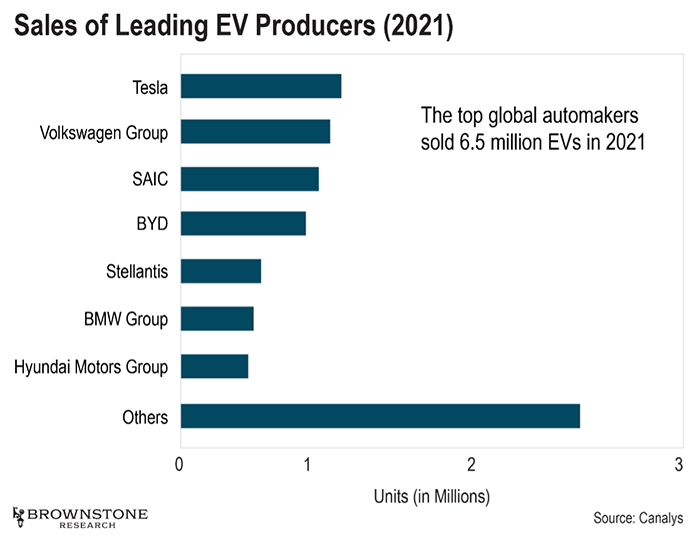

From an industry that moved just over 17,000 plug-in and all-electric vehicles in 2011, sales have climbed to over 6.5 million vehicles as of last year. That’s an incredible 38,135% increase in the span of just 10 years.

And by 2030, we can expect to see the number of EVs sold surge to more than 26.8 million vehicles worldwide.

EV technology now represents one of the biggest global investment opportunities.

Legacy automakers like Ford and General Motors are spending billions to focus their efforts on EVs. And EV giants like Tesla are setting standards for the entire industry thanks to their innovative tech.

And consumer EVs are not the only segment driving this megatrend…

Companies like Amazon have already begun to integrate self-driving trucks into their shipping lines. And Argo AI and Google’s Waymo division have made their own robo-taxi networks available to consumers across the U.S., with more offerings planned from the likes of Tesla and Uber in the near future.

Argo AI Test Footage

Source: YouTube

The exponential growth of EVs is already well underway. The technology is seemingly all around us at this point.

We are witnessing a flood of consumers into EVs… a whole surge of investment into the space… and even a major influx of government spending to support EV infrastructure around the world.

Electric vehicles have a bright future.

But there are still major hurdles the industry needs to overcome. These are the major pain points standing in the way of mass adoption.

And there is one class of investments addressing these issues right now… I’ve been watching this opportunity for years. And I believe these investments represent a greenfield opportunity for early investors.

Earlier this year, I presented at the Legacy Investment Summit on the topic of EV technology. And I focused especially on a handful of issues that I see as the industry’s biggest pain points…

EVs today are still mostly powered by “dirty energy” generated by fossil fuels.

Energy production from coal, which had been on a decline since 2013, spiked in 2021. And forms of renewable energy aren’t yet common enough to make up for the baseload power generated by fossil fuels and other “dirty” energy sources.

We have to ensure that EVs don’t negatively affect the environment. And for that to happen, we must make radical changes to the sources of power we use.

And that brings us to another major problem for the industry. I believe it’s the biggest hurdle the industry must overcome.

EV batteries don’t have comparable “mileage” to internal combustion engines (ICE). The industry is looking for ways to to produce these batteries at costs that are comparable to gas-powered engines.

I told attendees that mass adoption could only come about once the industry addressed these issues…

And right now, the industry is working diligently to solve these problems.

Over the last year, many electric vehicle technology companies have gone public. And despite the volatility, there are more in the pipeline for 2022. They’re all addressing the issues I’ve described above…

But many are refusing to go the conventional IPO route. Instead, they’re turning to a unique investment vehicle that I believe will accelerate the trend in electric vehicle adoption worldwide.

There are many bleeding-edge tech companies I’m watching in this space…

For example, I told attendees of my presentation about one of the most exciting private battery technology companies on my radar. It’s a company that promises to get more “mileage” out of our electric vehicles.

For perspective, standard EV batteries in use today are typically limited to 100 miles on a single charge.

However, this company’s special silicon anode cells can hold 73% more energy than Tesla’s Model 3 cells by weight. And its batteries can achieve an 80% charge in less than six minutes.

Now just imagine this tech applied to the world’s EVs…

There are many more companies like this. And they’re turning to a special type of investment vehicle to reach the public markets. I refer to it as a “Mandated Money” deal.

And within these “Mandated Money” deals is a special clause that you will not find in ANY other type of investment… It’s a special safeguard not offered by any conventional IPO.

It gives us the legal right to redeem shares and get our money back – all within a set timeframe.

I believe these “Mandated Money” opportunities can help early investors benefit from the global adoption of EV technology.

What’s more, they provide a path for early investors to gain exposure to many of the other tech trends I follow across my newsletters – everything from financial technology and gaming to the next generation of the internet fueled by blockchain technology.

So tonight at 8 p.m. ET, I’m hosting a special presentation that explores these unique deals. I’ll explain the institutional capital fueling these special investment vehicles… and I’ll provide my recommendation for one of the most promising EV suppliers reaching the public markets this year.

What’s more, I’ll also fill viewers in on the next wave of exciting tech companies using these investment vehicles to go public.

It’s all happening at my special event.

Just go right here to sign up for my special presentation. I hope to see you there.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.