Dear Reader,

I was rooting around the New York City Department of Health’s website a few days ago to figure out what was going on to cause such a panic.

New York had a delayed school opening this fall, with most schools opening to “blended” learning during the week of September 28. Blended means that the schools didn’t fully reopen to five days a week. Instead, they had a mix of on-campus and remote learning for children.

Yet days after this painful delay, the city shut down its schools a second time on October 5.

Something must have happened, right?

So I dug in. I wanted to understand why. Here is what I found. For reference, all of the charts below are unaltered and taken directly from the NYC Department of Health. I want you to see exactly what I’m seeing.

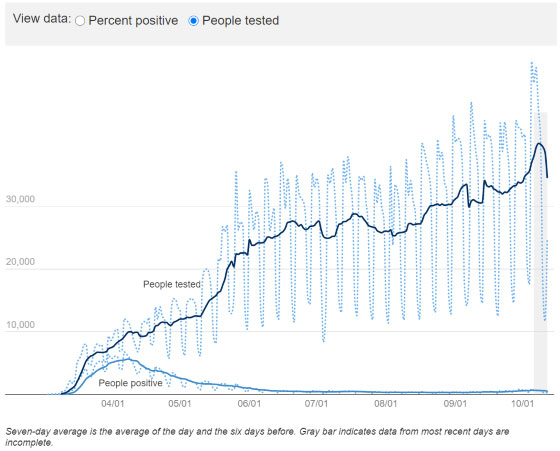

The chart below shows the number of COVID-19 tests a day in NYC. The dark-blue rising line is the seven-day rolling average number of tests, which have been increasing dramatically since March of this year. During the last week, the daily tests have been nearing 40,000 a day.

Virus (Diagnostic) Tests Performed From March Through October

Source: New York City Department of Health and Mental Hygiene

But when we look at the light-blue line at the bottom – the number of people who tested positive – that line has been flat since mid-June of this year.

No matter how many people NYC tests for COVID-19, the number of “people positive” never rises above more than a few hundred a day.

And that doesn’t even factor in the fact that 60–90% of all polymerase chain reaction (PCR) tests are false positives (i.e., people who receive a “positive” COVID-19 result but do not actually have COVID-19).

When we take these into account, the actual number of positive tests is insignificant.

So then I checked hospitalizations. Were they trending higher?

COVID-19 Hospitalizations From March Through October

Source: New York City Department of Health and Mental Hygiene

As we can see, since mid-June, hospitalizations from COVID-19-related illnesses have also been insignificant. There is clearly no crisis.

How about deaths?

COVID-19 Deaths From March Through October

Source: New York City Department of Health and Mental Hygiene

Again, almost nothing. In fact, on many days, there are no deaths related to COVID-19.

For comparison, there have been 346 murders in NYC year-to-date. Murders are already up 36% this year compared to last. More people have died from homicide than from COVID-19 since mid-June.

This is what herd immunity looks like.

The city can’t find any meaningful increase in new cases no matter how hard it tries. Hospitalizations have been flat for months, and related deaths have dropped to zero on many days.

Yet NYC is doubling down on heavy-handed lockdowns and denying children their education. For what? On what grounds?

This is absolute insanity.

Free New York City!

Now let’s turn to today’s insights…

Google’s self-driving division, Waymo, just announced that its autonomous taxi service is going live in the next few weeks.

The beta version of Waymo One first launched back at the end of 2018, but it was only available to a select few “early riders” in Phoenix. These early riders were required to sign nondisclosure agreements (NDA) promising not to take pictures or talk about the service. And each ride was made with a safety driver in the front seat in case anything went wrong.

Not surprisingly, Waymo One shut down due to the COVID-19 pandemic in March. But Waymo didn’t stop developing its technology.

What’s exciting about the upcoming relaunch of Waymo One is that it is going to be an open service that anyone can access. It covers an area of about 50 square miles in the Phoenix metro area. And here’s the best part – there won’t be a safety driver in the front seat.

This will be the world’s first fully autonomous taxi service… no safety driver required.

That begs the question – how can they go from a safety driver to no safety driver in the span of seven months?

Well, Waymo has been working to “geofence” this 50-square-mile area in Phoenix behind the scenes. That means it has mapped out all the streets and addresses.

And all the cars used in the service have the equivalent of a working memory to navigate within the geofence. That’s how Waymo is certain that the cars will be safe.

Waymo will also have “roaming” support vans with standby safety drivers ready to assist if a Waymo One vehicle gets stuck in some kind of situation that requires support.

And now is the perfect time to launch Waymo One without a safety driver.

With COVID-19 still in the news daily, many consumers are hesitant to come into close contact with strangers. Removing the safety driver will allow for a perfectly contactless experience. That is precisely what a fully autonomous ride-hailing service should look like.

This is such an exciting development.

I said in my 2020 prediction series during the holiday season last year that 2020 would bring us the first fully autonomous car available to the public.

That prediction is about to be proven correct. This is somewhat ironic, as many “experts” in the field thought this was crazy and wouldn’t happen for several more years.

Waymo also announced that it will gradually expand the service beyond these 50 square miles in Phoenix. But rides venturing out of the geofence will require a safety driver again.

What’s Waymo really up to? Will it roll out its autonomous ride-hailing service to other cities?

My prediction is that it will turn on a couple of more cities with different layouts than Phoenix to improve its technology, but that’s not the end game.

I’ve long held that Waymo is using these deployments as a way to demonstrate that the technology works. That way, it can license its technology to automotive manufacturers and self-driving, ride-hailing services.

It is stimulating the market to perpetuate its automotive operating system (OS) much in the way that Google did with Android for the smartphone market.

Richard Branson has been on a tear, investing in the next generation of transportation technology. We profiled Virgin Galactic’s new SpaceShip Two back in August.

What’s less known is that Branson also invested heavily in an early stage company called Virgin Hyperloop, which was founded in 2014.

Virgin Hyperloop develops hyperloop technology to deliver fast, direct, and autonomous transportation at scale. It utilizes magnetic levitation and vacuum tubes to power super-fast trains at speeds of 600 miles per hour or more. That’s fast enough to get from New York City to Washington, D.C., in 30 minutes.

This technology is the first major innovation for high-speed rails since the shinkansen (新幹線) was first launched in Japan back in the 1960s.

Japan and now China have some next-generation shinkansen (bullet trains) that use magnetic levitation technology, but they aren’t much different than the existing ones in terms of speed.

It’s hard to believe that more than 50 years have passed, and Japan’s technology from the 1960s is still widely in use with nothing new and exciting developed during that time. Hyperloop technology, originally envisioned by Elon Musk, shows great promise to be the innovation that the industry has been waiting for.

To that end, Branson just announced that Virgin Hyperloop is going to build a $500 million test track facility in West Virginia of all places. And get this – the facility is going onto the site of an old coal mine.

What a brilliant move.

In addition to revitalizing the area of an abandoned coal mine – representing times past – the new hyperloop facility will be conveniently located about 2.5 hours due west of Washington, D.C., by car.

That’s important because there will be regulatory hurdles that Virgin Hyperloop must navigate to make hyperloop transportation a reality in the U.S. Proximity to D.C. will help facilitate meetings with regulators.

As someone who spent the better part of two decades living and working in Japan, I can attest to the quality, comfort, convenience, and safety of high-speed rail travel. So I will certainly be cheering this effort on.

The next generation of transportation is long overdue. The technology has been in our hands for years now, so it is time to look to the future and put it to good use.

It’s rare that we talk about stodgy incumbents like IBM in The Bleeding Edge, but this flailing company just made a bold move.

New CEO Arvind Krishna announced that IBM plans to spin out its Managed Infrastructure Services unit into a new public company by the end of next year.

This is big news.

Managed infrastructure services are the core of IBM’s legacy business. This is what the company has been built on. But it is also the lower-margin, slow-growth portion of the business. That’s why IBM is dumping it onto a newly formed company.

As for IBM itself, it will keep everything related to cloud computing and artificial intelligence (AI). These are the new high-growth, high-margin parts of its business.

I have to applaud this move.

IBM needed to shake things up. The company has been plodding along for years, watching its revenues fall and its value gradually fade away. IBM was destined to die a slow death if nothing changed.

So this was just what the doctor ordered. IBM’s legacy business was acting like an anchor on its cloud computing and AI businesses. It was time to cut the anchor loose.

And the market agreed. IBM’s share price jumped 8% in two days on the news.

We don’t see this often, but this kind of move has been done before.

Back in 2017, one of our portfolio holdings in The Near Future Report, Delphi Technologies, decided to do the same thing.

Delphi had been a hardware and systems supplier to the auto industry for decades. But more recently, it had begun developing autonomous driving software, which is obviously a vastly different business.

Rather than keep the hardware and software businesses under the same roof, Delphi spun out a new company called Aptiv and moved the high-margin software business over to it. This left us with shares of both companies.

Of course, we made the decision to sell our shares in Delphi for a profit and hold Aptiv for an even bigger profit.

As technology investors, it’s typically better to focus on high-margin, high-growth businesses as opposed to low-margin, low-growth businesses. Common sense, right?

And that proved true in this case, as APTV raced 43% higher in the following 12 months.

So I see this as a great move for IBM. And it may make the stock much more interesting to me once the spinout is complete.

I plan to keep an eye on how the spinout comes together and what the “new” IBM looks like around this time next year.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. Don’t forget to mark next Wednesday, October 21, on your calendar. At 8 p.m. ET that evening, I’m going to reveal what I learned on my recent tour of America’s heartland.

As I have mentioned the last few days, I’ve been traveling thousands of miles the past few weeks doing research on the fastest-growing technology on the market today. This kind of “boots on the ground” research is where my best investment ideas come from.

And next Wednesday, I’m going to share what I’ve learned with you – including some video we filmed from my journey through the Heartland.

The entertainment value alone will be well worth the time. And I will also discuss what I believe will be the top growth story of the next decade. I believe savvy tech investors who understand this trend stand to do very well.

So save the date – October 21 at 8 p.m. ET.

For readers who are interested in attending, just go right here to reserve your spot.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.